Home Depot Profit Gains In Good Omen for Retail -- WSJ

26 Fevereiro 2020 - 5:02AM

Dow Jones News

By Dave Sebastian

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 26, 2020).

Home Depot Inc. posted higher profit for its latest quarter, a

sign of health for the U.S. economy following lackluster sales

reports from other retailers in recent weeks.

Its finance chief also said the company is adequately stocked

for the current period despite the effect the coronavirus epidemic

is having on global supply chains

"We feel good about where we stand with respect to product for

the first quarter," Richard McPhail said in an interview.

He said Home Depot sources 30% of its products from other

countries, mostly from China, but that it is still too early to

determine whether supply-chain disruptions would materially affect

the company's financial performance.

The home-improvement retailer on Tuesday reported net income of

$2.48 billion, or $2.28 a share, for its fiscal fourth quarter,

which ended Feb. 2. Analysts polled by FactSet had expected $2.10 a

share. Profit in the year-earlier period was $2.34 billion, or

$2.09 a share.

Home Depot said sales for the latest period declined 2.7% to

$25.78 billion, roughly in line with analysts' expectations. The

Atlanta-based company said the extra week of operations in the

year-earlier period contributed about $1.7 billion in sales.

Sales at physical and online outlets that had been open for more

than a year rose 5.2% for the period, ahead of the 4.7% rise

analysts were expecting. The company had missed same-store-sales

expectations for the previous four quarters, according to

FactSet.

On one less week, the number of customer transactions fell 6.4%

from a year earlier, but the average amount each customer spent

rose 4.1% and sales per retail square foot rose 2.8%. Operating

expenses fell 5.6% to $5.33 billion for the quarter.

Home Depot shares, which have risen about 24% in the past year,

were off less than 1% Tuesday, while the Dow Jones Industrial

Average slumped for a second day in a row on mounting fears over

the epidemic's spread outside of China.

Home Depot's domestic business remains resilient to risks such

as coronavirus and the trade war, and customers in coming months

could shift their discretionary spending to home improvement from

travel plans, especially outside the U.S., CFRA Research analyst

Kenneth Leon said in a note to clients.

During its latest quarter, Home Depot saw some benefit from

refunds on tariffs imposed on certain Chinese goods that were

subsequently exempted, Ted Decker, the executive vice president of

merchandising, said on a call with analysts. He said luxury vinyl

plank flooring was a major Home Depot category that had been

subject to tariffs.

Home Depot affirmed its financial outlook for the current fiscal

year. It expects per-share earnings to grow about 2% to $10.45 on

same-store-sales growth of about 3.5% to 4%. It also raised its

quarterly dividend by 10% to $1.50 a share.

The company, which operates about 2,300 stores, expects to open

six new stores during the year.

Mr. McPhail said on the analyst call that the guidance assumes

the U.S. economy will grow slightly less than 2% this year and a

boost to demand from rising home prices and housing turnover.

"The economy is strong, and the U.S. consumer is healthy," Mr.

McPhail said.

Average home prices in major U.S. metropolitan areas rose 3.8%

in 2019, accelerating from an annualized increase of 3.5% the prior

month and 3.3% in October, according to the S&P CoreLogic

Case-Shiller National Home Price Index. The pace marks a full eight

years of price increases in homes for sale.

"Home-improvement sales will benefit from low rates on mortgages

and home-equity loans, rising home prices, and a growing market in

2020 home sales," Mr. Leon said.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

February 26, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

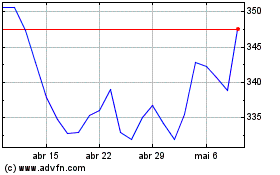

Home Depot (NYSE:HD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Home Depot (NYSE:HD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024