Eni Withdraws Buyback Proposal; Revises 2020-21 Business Plan Due to Coronavirus, OPEC

18 Março 2020 - 3:17PM

Dow Jones News

By Giulia Petroni

ENI SpA said Wednesday that it has withdrawn its share buyback

proposal and would revise its business plan for the 2020-21 period

due to coronavirus and recent decisions taken by the Organization

of the Petroleum Exporting Countries.

The Italian oil-and-gas company said the proposal to authorize a

400 million euro ($442.6 million) buyback in 2020 will be withdrawn

and could be reconsidered only if Brent crude--the global

benchmark--for the referenced year will be equal to at least $60 a

barrel.

Eni cut its price forecasts for Brent to $40/bbl to $45/bbl in

2020 and $50/bbl to $55/bbl in 2021 and said it's reviewing its

business plan for the period. Details of the revised plan will be

set out on April 24 during first-quarter results.

"This revision will consider a strong reduction in the capex and

expected costs to levels that are consistent with the new price

scenario," said Chief Executive Claudio Descalzi.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

March 18, 2020 14:02 ET (18:02 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

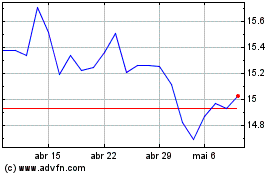

Eni (BIT:ENI)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

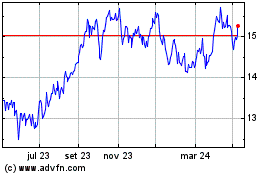

Eni (BIT:ENI)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024