Ford Nixes Dividend, Suspends Guidance

19 Março 2020 - 11:43AM

Dow Jones News

By Matt Grossman and Mike Colias

Ford Motor Co. said Thursday it would shore up its balance sheet

by drawing on credit lines and suspending dividends as the Covid-19

pandemic roils the economy.

The company also withdrew its guidance for 2020 issued in early

February, citing economic uncertainty. Ford had guided for adjusted

earnings per share of 94 cents to $1.20.

The automobile giant told its lenders that it will draw down the

entirety of two lines of credit, including $13.4 billion from a

corporate credit facility and $2 billion from a supplemental

facility. Ford also suspended its dividend, a move aimed to improve

financial flexibility in the short term, it said.

The dividend suspension could save the company roughly $2.4

billion annually.

"While we obviously didn't foresee the coronavirus pandemic, we

have maintained a strong balance sheet and ample liquidity so that

we could weather economic uncertainty and continue to invest in our

future," Jim Hackett, Ford's chief executive, said in a

statement.

Ford also unveiled a plan to relieve customers of payments on

some new cars. For buyers of 2019 and 2020 model-year vehicles, the

company said it will cancel three months' worth of payments and

would defer three additional months.

Ford last suspended its dividend in 2007, ahead of the financial

crisis, during which it narrowly avoided bankruptcy. It restored

its dividend in 2012.

Ford's decision to temporarily close all its factories in North

America through at least March 30 will have an immediate impact on

its cash flow and bottom line, because car makers book revenue as

soon as they ship vehicles from the plant to the dealership.

The company relies on the North America market and its in-house

lending arm for virtually all of its global profit, having swung to

losses overseas. A protracted shutdown of its plants in the U.S.,

Canada and Mexico would have a severe impact on its cash flow and

operating profit, analysts say. The company also has suspended some

production in Europe.

The company is in the midst of an $11 billion, multiyear

restructuring that has crimped its cash flow, which already had

been dwindling in recent years. Company executives have said the

dividend is being funded from cash on the balance sheet, rather

than cash flow, but had planned to continue paying it.

"We like to return value to shareholders," Mr. Hackett said

during a conference call with analysts in February. "The dividend's

been a legendary value creator at Ford...I want to continue

that."

Write to Mike Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

March 19, 2020 10:28 ET (14:28 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

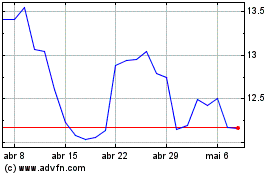

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

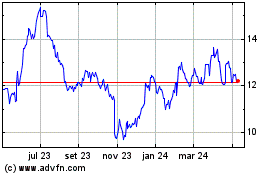

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024