Stocks: Expectations Grow For Dividend Cuts -- WSJ

20 Março 2020 - 4:02AM

Dow Jones News

By Akane Otani

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 20, 2020).

Funding strains and sliding sales are forcing a growing number

of companies to slash or suspend their dividend payouts.

Hundreds of S&P 500 companies issue dividends -- payouts

that companies make to shareholders as a reward for standing by

them. Before the coronavirus pandemic hit the world, S&P Dow

Jones Indices estimated dividend payouts for the year would top

$500 billion to set a new record.

But because the pandemic has upended the global economy,

shutting down factories and stores around the world and forcing

companies to throw out their profit forecasts, analysts expect

dividend payouts to fall sharply. That could add to the woes of

beaten-down stocks that have often relied on steady dividend

payouts to compensate investors for less robust profit growth.

While the broader market was near flat, a ProShares

exchange-traded fund tracking the S&P 500 Dividend Aristocrats

Index fell 1.7% Thursday. The index tracks shares of companies that

have raised dividends every year for the past 25 years. It has

dropped 27% over the past month, generally in line with the broader

market, and the yield on the fund has slipped to 2.6%.

Shares of Ford Motor Inc., which said Thursday that it was

suspending its dividend to try to preserve its dwindling cash pile,

fell 0.7%.

With everyday life becoming increasingly disrupted in the U.S.

and other countries, analysts expect the list of companies cutting

their dividends to grow in the coming weeks.

Boeing Co. has a dividend yield of around 8.4%. Because

disruptions on travel are expected to take a heavy toll on the

aerospace industry, Boeing has said it supports a minimum $60

billion aid package from the federal government. Given the

financial strain it is under, the company is considering cutting

its dividend, people familiar with the matter told The Wall Street

Journal.

Other companies that may follow suit: Exxon Mobil Corp., which

has a dividend yield of around 10%, and Chevron Corp., which has a

dividend yield of about 9%. Both companies are dividend

aristocrats. The former has raised its dividend payout for 37

consecutive years. Cutting the payout would potentially be a major

blow -- especially given analysts' grim forecasts for profitability

in the oil sector this year.

While Exxon hasn't committed to any changes to its dividend yet,

it said Tuesday that it was looking at ways to slash spending

because of the pandemic and the global selloff in commodities

prices.

"Based on this unprecedented environment, we are evaluating all

appropriate steps to significantly reduce capital and operating

expenses in the near term," said Darren Woods, chairman and chief

executive of Exxon, in a statement. "We will outline plans when

they are finalized."

Write to Akane Otani at akane.otani@wsj.com

(END) Dow Jones Newswires

March 20, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

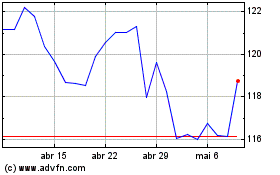

Exxon Mobil (NYSE:XOM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

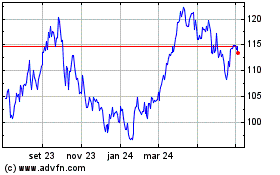

Exxon Mobil (NYSE:XOM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024