Glencore Says No Material Disruption to Businesses, Supply Chain from Pandemic

20 Março 2020 - 12:41PM

Dow Jones News

By Ian Walker

Glencore PLC said Friday that there hadn't been any material

disruptions to its businesses or supply chain, but certain smaller

operations were affected by restrictions made by governments around

the world in reaction to the coronavirus pandemic.

The Anglo-Swiss commodities giant--one of the world's biggest

producers of raw materials such as copper, cobalt and coal--added

that its marketing business is delivering annualized earnings

before interest and tax within its long-term guidance of $2.2

billion to $3.2 billion a year.

Glencore added that liquidity has increased since the start of

the year to due lower working capital requirements, weakening of

currencies against the U.S. dollar and falling oil prices. It had

$10 billion of undrawn credit and cash at the end of 2019.

Earlier this week Glencore postponed its annual general meeting

which was due on May 6 after the Swiss Federal Council's decree

banning public meetings. It said Wednesday that the company must

hold meeting by June 30 under its articles of association, and will

provide a new date by the end of May.

London-listed shares at 1505 GMT were up 5.64 pence, or 4.8%, at

122.94 pence.

Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

(END) Dow Jones Newswires

March 20, 2020 11:26 ET (15:26 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

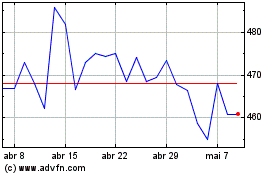

Glencore (LSE:GLEN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

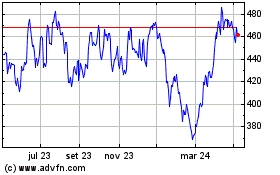

Glencore (LSE:GLEN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024