Europe's Corporate Bond Market Shows Muted Signs of Revival

20 Março 2020 - 4:25PM

Dow Jones News

By Anna Isaac and Anna Hirtenstein

Europe's bond market proved it remains open for blue-chip

companies -- amid the global rout in other sectors -- after

consumer-goods giant Unilever PLC and French energy producer Engie

SA sold about EUR4.5 billion ($4.8 billion) in bonds.

The two businesses were the only companies to successfully tap

the region's debt markets this week, according to data from

Dealogic.

The deals are also "a sign that people can work with capital

markets while sitting at their kitchen table," Tomas Lundquist, a

managing director at Citigroup who helped arrange the deals, said

in an interview.

Europe's debt markets haven't shut down completely, even as

investors have shunned global stocks, bonds and commodities in

recent weeks. Deal making had slowed to a trickle, with only the

most creditworthy companies finding buyers. Junk-rated companies,

on the other hand, have been virtually closed out of the market as

investors sold off even the safest assets and sought to hold

cash.

Last week, French food products company Danone raised EUR800

million, while German trainline Deutsche Bahn tapped the bond

market for EUR150 million, according to Dealogic.

This week, Unilever raised about EUR2 billion from five-year and

10-year bonds, while Engie issued EUR2.5 billion of five-, eight-

and 12-year bonds, according to Citigroup. The bonds were priced on

Friday. Unilever is rated A1 by Moody's Investors Service, while

Engie has an A3 credit rating.

(END) Dow Jones Newswires

March 20, 2020 15:10 ET (19:10 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

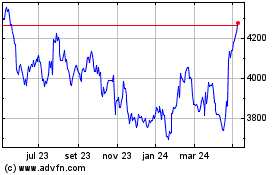

Unilever (LSE:ULVR)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

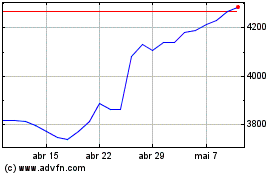

Unilever (LSE:ULVR)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024