Chevron Plans Cuts to Capital Budget

24 Março 2020 - 8:34AM

Dow Jones News

By Christopher M. Matthews

Chevron Corp. is cutting $4 billion from its capital budget as

it confronts plummeting petroleum demand and an oil-price rout, the

latest major energy company to axe its spending to shore up its

balance sheet.

The oil giant said Tuesday it would reduce its 2020 spending by

20% to about $16 billion, with the biggest cut to come in the

largest U.S. oil field, the Permian Basin in West Texas and New

Mexico. Chevron will also suspend stock buybacks but promised to

protect its dividend and said oil production would be flat.

Chief Executive Mike Wirth said the dual shock of the oil

demand-sapping coronavirus pandemic and an increase in supply due

to the oil-price war between Saudi Arabia and Russia necessitated

drastic measures.

"To see these two things happen simultaneously is really

unprecedented," Mr. Wirth said in an interview. "We can't control

that, but we're focused on making the moves that will preserve the

strength of our company."

Chevron's announcement follows similar austerity measures by its

peers and other large industrial companies.

On Monday, Royal Dutch Shell PLC halted its $25 billion share

buyback program and cut its capital expenditures by 20% in 2020 to

$20 billion from $25 billion. Total SA said Monday it planned to

trim spending by $3 billion, halt $2 billion in buybacks and borrow

$4 billion to make up for a $9 billion shortfall created by low oil

prices. ExxonMobil Corp. said last week it planned to make

significant cuts to its spending.

(END) Dow Jones Newswires

March 24, 2020 07:19 ET (11:19 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

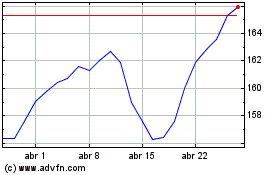

Chevron (NYSE:CVX)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

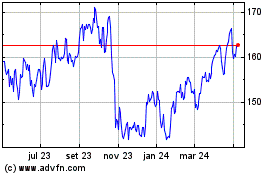

Chevron (NYSE:CVX)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024