Chevron CFO Turns to Crisis-Era Playbook Amid Coronavirus, Oil-Price Rout

24 Março 2020 - 8:40PM

Dow Jones News

By Nina Trentmann and Mark Maurer

Chevron Corp.'s chief financial officer is resorting to a tested

playbook that involves slashing capital expenditures and reducing

costs to respond to a sharp decline in oil prices and lower

petroleum demand.

"It's obviously more extreme than we expected," Chevron CFO

Pierre Breber said in an interview.

The San Ramon, Calif.-based oil giant Tuesday said it would cut

$4 billion in capital expenditures amid lower oil consumption

caused by the coronavirus pandemic and the continuing oil price-war

between Russia and Saudi Arabia. Oil prices have fallen more than

half since the beginning of the year to around $30 a barrel.

Chevron said it would reduce its 2020 spending by around 20% to

about $16 billion, with deep cuts to its Permian Basin project in

West Texas and New Mexico. Chevron said it also would suspend share

buybacks but pledged to keep its dividend.

There will be additional cuts to operational costs associated

with capital programs, said Mr. Breber, a company veteran who took

over Chevron's finance function last April.

Mr. Breber said his response to the coronavirus pandemic focuses

on preserving short-term cash, managing liquidity and protecting

the dividend, a set of actions that mirror those taken by the

company in response to the 2008 financial crisis and the 2014

oil-price drop.

Chevron significantly cut staff during both periods, and in the

latter case, reduced capital spending.

Mr. Breber said he talked to predecessors Patricia Yarrington,

who ran Chevron's finances from 2009 to 2019, and Steve Crowe, who

served as CFO before Ms. Yarrington, to discuss Chevron's response

to the steep decline in oil prices in recent weeks.

Chevron has more flexibility than during previous crises to

reduce production and cut spending, according to Bill Selesky, an

analyst at Argus Research Co. "Back in 2008, 2009, the Permian

Basin was not a big deal," Mr. Selesky said. "Today it is -- and

they can turn it on and off depending on where the oil price

sits."

S&P Global Inc. on Monday forecast Brent oil to average $30

a barrel for the remainder of the year and West Texas Intermediate,

the U.S. oil-price benchmark, to stay at around $25 a barrel.

"We don't know exactly what's going to happen in the short term,

but we have to prepare for what looks like much lower demand in the

short term and more supply," Mr. Breber said.

Chevron earlier this year presented a five-year outlook based on

an average price of $60 a barrel for Brent. Even though the

assumptions have changed, it helps to have a long-term framework,

Mr. Breber said. "It's fundamentally looking at a medium-term

financial framework where you're looking for cash balance," he

said.

The company likely will observe how the market develops in the

next few months before making more cost-cutting moves, said Jason

Gabelman, an analyst at Cowen & Co. "I don't think that you

want to do too much too fast because those decisions could

ultimately be incorrect if the market turns on you and then you've

become less efficient," he said.

Chevron's move follows similar actions by other oil companies,

including Royal Dutch Shell PLC, Total SA and Exxon Mobil Corp.

Total, for example, said it plans to cut $3 billion in spending,

borrow $4 billion and suspend $2 billion in share buybacks.

Write to Nina Trentmann at nina.trentmann@wsj.com and Mark

Maurer at mark.maurer@wsj.com

(END) Dow Jones Newswires

March 24, 2020 19:25 ET (23:25 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

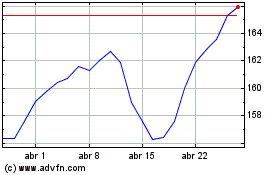

Chevron (NYSE:CVX)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

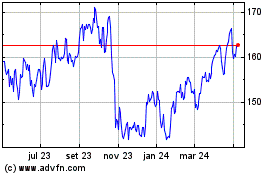

Chevron (NYSE:CVX)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024