By Tripp Mickle

After losing his job last week as a sports-radio producer, Adam

Michaels scrutinized his family's spending. Among this year's

planned cutbacks amid the economic devastation wrought by the

coronavirus pandemic: no new iPhones.

It is a departure for the 42-year-old, Chicago-area resident,

who typically buys his family four new iPhones every two years.

"The expense is not worth it right now," Mr. Michaels said.

The question of consumer demand looms large for Apple Inc. as it

prepares to unveil a new low-price iPhone model and soon must begin

ordering components for its latest flagship smartphones, which

usually are launched in the fall. The fall iPhones, which this year

were expected to garner significant consumer interest because of

the use of 5G wireless technology, make up a sizable portion of the

company's revenue.

An Apple spokesman declined to comment.

Consumer demand in the age of coronavirus has quickly emerged as

the biggest unknown for companies from soft-drink makers to

airlines. European and U.S. lockdowns have triggered a sharp,

unprecedented economic contraction that has left many businesses

without a road map for what lies ahead.

Apple, which has navigated past economic challenges, has been

whipsawed by the viral outbreak. The health crisis began in China,

where it closed factories and eroded iPhone supplies. It then

bounced to Europe and the U.S., forcing Apple to shut down stores

and almost all activity at its Silicon Valley campus.

Sales of iPhones peaked in 2015, and the company has been

focused on persuading customers to replace old devices -- a much

tougher task amid an economic crisis. The less-expensive iPhone

heading to the market could be a better fit for a cost-conscious

time, but its lower price and targeted audience -- emerging markets

and existing customers -- also will make it a modest contributor to

Apple's bottom line. The new model, which has been compared with

the $399 iPhone SE offered in 2016, was expected to be launched

this month but might be delayed, analysts say.

Apple's new flagship models are usually unveiled in September,

so the 5G phones are months away. However, the company's operations

team typically places orders in March and April for camera modules

and other components for iPhone assembly in summer months, former

employees said.

They said orders dictate how many new devices Apple makes, and,

under the shadow of the pandemic, consumer demand has never been

more unclear. It is further complicated by lofty iPhone prices,

after Apple three years ago raised its flagship models to $1,000 --

a 50% increase that lifted revenue as shipments fell.

The uncertain market has unnerved Apple's suppliers, who said

they are now concerned iPhone shipments will decline this year

instead of rising, as many analysts had expected. Apple's next

quarterly report is due out in late April. In 2018, suppliers

suffered when Apple misread demand and slashed production, sticking

some suppliers with excess inventory and underused production

capacity.

The coronavirus has already hammered the smartphone industry,

which compared with a year earlier shipped 38% fewer units

world-wide last month amid China's shutdown, according to Strategy

Analytics. It was the biggest single-month decline in industry

history.

Apple relies on Europe and the U.S. for about two-thirds of

sales and faces growing risk as those countries now combat the

public-health crisis. The U.S. alone is predicted to lose as many

as five million jobs this year as restaurants, airlines and hotels

reel in the face of travel restrictions.

Apple's shares have fallen about 15% in the past month, in line

with tech peers such as Microsoft Corp. and Facebook Inc. but less

than the 28% decline in the S&P 500, according to FactSet.

Apple Chief Executive Tim Cook has encouraged staff in emails

not to worry about the challenges confronting the company. He

indicated that Apple -- which has about $200 billion in cash and

cash equivalents -- is prepared for this moment and will continue

to invest in the future.

The company has forged ahead with software updates and new

products, including an updated MacBook Air and iPad Pro. Apple also

has pushed to increase sales of apps with an App Store expansion

into 20 new countries.

Pressure to order the right number of components in the face of

fast-changing consumer behavior is especially high as Apple moves

into 5G, the next generation of wireless technology. The 5G models

require pricier modems and more memory that analysts say will

increase costs of materials by $100 a phone.

Being stuck with extra modems or unsold 5G iPhones could cut

into the rich profit margins that helped make Apple the first U.S.

company valued at $1 trillion, said Mehdi Hosseini, an analyst with

Susquehanna International Group. He expects Apple to have component

suppliers continue making iPhone parts as planned while it

reassesses demand in May or June.

The factories Apple relies on in China to make its products have

restarted operations, but a stay-in-shelter order in California has

forced staff to work remotely, complicating the well-oiled process

that has long guided Apple's iPhone development.

Apple is scrambling to prevent product delays. Unable to travel

to China, its U.S. engineering team is using video calls to direct

Chinese colleagues through iPhone prototype assembly at factories

in Asia, people familiar with the matter said. The company

previously did a test run of that process in January.

The company last week also began allowing some engineers to take

home prototypes of some future products, people familiar with the

matter said, an unprecedented step for a company that has fired

software engineers for coding off campus and used security staff to

transport future iPhones. It asked employees not to discuss the new

protocols.

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

March 26, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

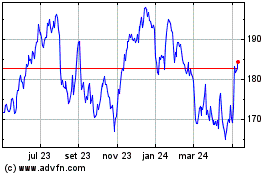

Apple (NASDAQ:AAPL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

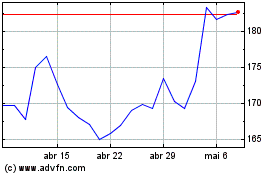

Apple (NASDAQ:AAPL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024