U.S. Auto Sales Drop as Health Crisis Bites -- WSJ

02 Abril 2020 - 4:02AM

Dow Jones News

By Nora Naughton

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 2, 2020).

A collapse of showroom traffic in March led to a big drop in

U.S. sales for major car companies in the first quarter,

illustrating how quickly the coronavirus outbreak has dented

business for one of the nation's largest industries.

Fiat Chrysler Automobiles NV reported a 10% drop in

first-quarter U.S. sales, saying strong results in January and

February were more than offset by the impact of the virus in

March.

General Motors Co. said its U.S. sales were down 7% in the

January-to-March period, citing similar reasons, while Nissan Motor

Co. reported a 30% drop in the first quarter.

Hyundai Motor Co.'s U.S. sales were off 11% for the first

quarter and Toyota Motor Corp. reported a nearly 9% decline.

Ford Motor Co. will release its first-quarter sales results

Thursday.

The weaker first-quarter results provide a window into what is

ahead for the U.S. car business as the outbreak continues to shut

down large parts of society. Analysts in recent weeks have rushed

to cut their U.S. sales forecasts, and executives and dealers

expected the sales declines to only deepen in April with a rebound

not likely until the summer, at the earliest.

"Consumers obviously and understandably shifted their

priorities," said David Kershaw, Nissan's U.S. sales chief. "The

situation is very fluid right now and everybody's trying to get

their arms around where and how this is going to play out."

Car companies already had been grappling with collapsing sales

in Europe and China as the virus spread around the globe earlier

this year. But new-car demand in the U.S. has held strong, all the

way through the first half of March, analysts and dealers said.

The turning point came midmonth, when buyers began steering

clear of showrooms to avoid interactions with others and possible

exposure to the virus. U.S. car factories went dark soon after and

many dealers have since temporarily closed their locations to

comply with stay-at-home orders.

For March alone, analysts are expecting sales to have decreased

by about a third compared to the same month last year. Toyota's

sales last month fell nearly 37%, while Hyundai's dropped 43%.

"This is a sign of things to come," said Jessica Caldwell, an

analyst with car shopping website Edmunds.com. "April is going to

be another tough month. It's going to be hard for any company to

move the needle."

Some retailers are trying to stimulate business by promoting

online sales and at-home delivery services, allowing buyers to

purchase a car without having to leave their homes. That has helped

some, analysts say, but the bigger challenge is customers are

delaying purchases altogether.

Auto makers, rushing to salvage business, have also responded by

reviving sales promotions used during the 2007-09 recession, such

as no-interest loans, delayed first payments and protection plans

that give buyers relief if they lose a job.

Fiat Chrysler on Wednesday said starting in April it will offer

customers 0% financing for seven years and deferred payments for

three months.

Those kinds of no-interest finance deals helped lift pickup

truck sales for the Detroit car companies in March, said Tyson

Jominy, a J.D. Power auto analyst. But it is unclear if such

promotions helped business more broadly because many were rolled

out late in the month.

One point of relief for the industry, dealers and analysts say,

is that while demand craters, nearly all U.S. factories have also

closed due to parts shortages orders and to curb the spread of the

coronavirus. That will help auto makers avoid unwieldy stockpiles

of unsold cars.

The U.S. auto industry entered the year with expectations that

vehicle sales, while slowing from a peak of 17.6 million in 2016,

would remain healthy. Now, some forecasters are predicting sales

could dip as low as 13.5 million in 2020 -- a level not seen since

2010 when the industry was only starting to emerge from the

financial crisis.

Dealers who remained open last month saw business nosedive as

buyers canceled appointments and avoided showrooms.

George Waikem II, treasurer of Waikem Auto Family, a dealership

chain in Ohio, said store traffic was off 60% last month compared

with February and he doesn't expect it to improve anytime soon.

"I'll be happy with 50% of what we did last year," he said, of

April. "Well, I won't be happy but that's what we're hoping

for."

--Ben Foldy contributed to this article.

(END) Dow Jones Newswires

April 02, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

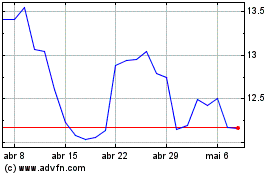

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

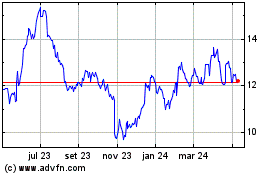

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024