Apple Sales Rise Slightly, Showing Resilience in Pandemic

30 Abril 2020 - 6:28PM

Dow Jones News

By Tripp Mickle

Apple Inc. reported a slight uptick in revenue for the second

quarter despite the coronavirus shutting down factories and denting

sales in China, as the tech giant's growing services business

offset declining iPhone sales.

The company said revenue rose 1% in its fiscal second quarter to

$58.3 billion, with iPhone sales momentum stalling after Apple

closed stores, first in China and later world-wide. Profit fell

about 3% to $11.25 billion, or $2.55 a share.

The results exceeded analysts' revised expectations for nearly

$55 billion in revenue but fell short of the company's pre-pandemic

projections for more than $63 billion for the three months ended

March 28.

The quarter's results highlight the strengths of big technology

companies even during an economic crisis that has rocked markets

around the world and consistently tested corporations. Some have

seen increased business as the virus keeps people at home. Facebook

Inc. and Microsoft Corp. on Wednesday reported higher revenue and

signaled more gains in the current period as home-bound

social-media usage swells and cloud-computing rises. Google parent

Alphabet Inc. last week posted revenue gains but provided a sober

outlook, saying it experienced a sudden slowdown in ad sales in

late March.

Apple's performance also underscored the value of its strategic

shift from selling more devices to selling more software and

services across those devices. The company reported quarterly sales

from services rose nearly 17% to $13.35 billion, offsetting a 3.4%

decline in its legacy hardware products such as iPhones, iPads and

Macs, which posted sales of $44.97 billion.

Apple said it would add $50 billion to its continuing

share-buyback program, a decrease from last year's addition of $75

billion but still an encouraging sign of its commitment to return

capital even as buybacks have become controversial in the U.S. Its

board also approved a 6% increase in its quarterly dividend,

building on last year's 5% increase

Other companies with large businesses in China also struggled

amid the pandemic. Starbucks Corp. reported Monday that same-store

sales in China were down 90% at the peak of the outbreak and said

it would reduce the number of new stores it plans to open this year

by 17% to 500. Adidas AG, which counts on China for a fifth of

total revenue, said Tuesday its sales in Greater China fell sharply

amid store closures.

Apple offset declines in China with strong sales in the U.S. and

Europe, where shutdowns didn't begin until the final weeks of the

March quarter. Apple relies on the U.S. and Europe for about

two-thirds of total sales, and those economies are now suffering

historic contractions that could lead to an unprecedented drop in

sales for Apple if those markets trace China's decline in the March

period.

"Few companies are able to outrun this pandemic, and Apple is no

exception," said Daniel Flax, senior research analyst at Neuberger

Berman, an investment manager with $356 billion in assets under

management that counts Apple among its holdings.

Despite the near-term challenges, Mr. Flax said Apple stands to

gain in the future with critical products for people working

remotely and a strong balance sheet to fund innovation.

Apple has been quick to react as the coronavirus outbreak

gathered speed.

In February, it became one of the first companies to signal

trouble ahead, saying it wouldn't meet its revenue projections

because of weak demand in China and supply shortages. It also

closed its China stores that month and later extended the shutdown

to all stores world-wide in mid-March. The company has since

reopened stores in China and elsewhere such as South Korea,

although U.S. stores remain closed.

After the virus hit the U.S., Apple donated 20 million masks to

health-care workers and partnered with Google to create software

that enables smartphones to help track the spread of the virus.

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

April 30, 2020 17:13 ET (21:13 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

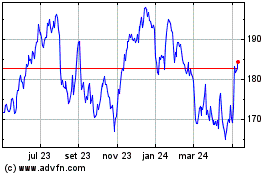

Apple (NASDAQ:AAPL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

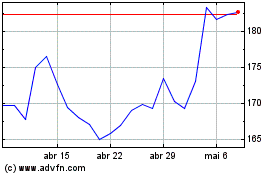

Apple (NASDAQ:AAPL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024