By Tripp Mickle

Apple Inc. reported a slight uptick in revenue for its latest

quarter despite the coronavirus shutting down factories and denting

sales in China, as the tech giant's growing services business

offset declining iPhone sales.

The company said revenue rose 1% in its fiscal second quarter to

$58.3 billion, with iPhone sales momentum stalling after Apple

closed stores, first in China and then world-wide. Profit fell

about 3% to $11.25 billion, or $2.55 a share.

The results exceeded analysts' revised expectations for nearly

$55 billion in revenue but fell short of the company's pre-pandemic

projections for more than $63 billion for the three months ended

March 28.

In the face of historic economic uncertainty, Apple declined to

project sales for its current quarter for the first time since it

began providing concrete revenue guidance in late 2003. The

omission means Apple can avoid having to revise its sales

projections in the coming months -- an action it had to do twice in

the past two years because of unexpected economic downturns in

China.

"Apple is one of very few companies that can survive Armageddon

because their balance sheet is in better shape than Uncle Sam,"

said Mike Frazier, president of Bedell Frazier Investment

Counselling, a Walnut Creek, Calif.-based firm with about $500

million under management.

The quarter's results highlight the strengths of big technology

companies even during an economic crisis that has rocked markets

around the world and put corporations to the test. Some have seen

increased business as the virus keeps people at home. Facebook Inc.

and Microsoft Corp. on Wednesday reported higher revenue and

signaled more gains in the current period as homebound social-media

usage swells and cloud-computing rises. Google parent Alphabet Inc.

last week posted revenue gains but provided a sober outlook, saying

it experienced a sudden slowdown in ad sales in late March.

Apple's performance also underscored the value of its strategic

shift from selling more devices to selling more software and

services across those devices. For the quarter, the company's sales

from services rose nearly 17% to $13.35 billion, offsetting a 3.4%

decline in its legacy hardware products such as iPhones, iPads and

Macs, which reaped sales of $44.97 billion.

The company's wearables business posted sales growth of 23% to

$6.28 billion behind strong demand for AirPods wireless earbuds and

smartwatches.

"Amid our most challenging global environment in which we've

ever operated our business, we're proud to say that Apple grew,"

Chief Executive Tim Cook said Thursday. He said the results speak

to Apple's "durability as a business and the enduring importance of

our products in our customers' lives."

Apple said it would add $50 billion to its continuing

share-buyback program, a decrease from last year's addition of $75

billion but still a sign of its commitment to return capital even

as buybacks have become controversial in the U.S. Its board also

approved a 6% increase in its quarterly dividend to 82 cents a

share, building on last year's 5% increase.

Mr. Frazier said the buybacks and dividend increases will

instill confidence in Apple's "rock solid balance sheet."

The results suggest the economic damage from the pandemic may

not be as bad for some companies as feared. Apple, which relies on

China for nearly a fifth of total revenue and for almost all of its

manufacturing production, had high exposure to the economic fallout

there as it became the first country to lock down its economy to

curtail the outbreak. Apple's sales fell 7.5% to $9.46 billion

across its Greater China region, which includes Hong Kong and

Taiwan -- a far-less-dramatic downturn than, for example, the 90%

same-store sales decline Starbucks Corp. reported Monday.

Still, Apple's dependency on China to make almost all of the

iPhones it sells world-wide proved a challenge as February factory

closures disrupted production. The stoppage delayed the release of

the iPhone SE by a month, according to analysts, pushing sales of

the smartphone out of the March quarter when it was expected to

lift revenue. A two- to three-week shutdown of factories also

slowed shipments and sales of iPhones outside China, according to

analysts.

The company reported iPhone sales fell 7% to $28.96 billion in

its March quarter.

Apple offset declines in China with strong sales in the U.S. and

Europe, where shutdowns didn't begin until the final weeks of the

March quarter. Apple relies on the U.S. and Europe for about

two-thirds of total sales, and those economies are now suffering

historic contractions that could lead to an unprecedented drop in

sales for Apple if those markets trace China's decline in the March

period.

"Few companies are able to outrun this pandemic, and Apple is no

exception," said Daniel Flax, senior research analyst at Neuberger

Berman, an investment manager with $356 billion in assets under

management that counts Apple among its holdings.

Despite the near-term challenges, Mr. Flax said Apple stands to

gain in the future with critical products for people working

remotely and a strong balance sheet to fund innovation.

Apple has been quick to react as the coronavirus outbreak

gathered speed.

In February, it became one of the first companies to signal

trouble ahead, saying it wouldn't meet its revenue projections

because of weak demand in China and supply shortages. It also

closed its China stores that month and later extended the shutdown

to all stores world-wide in mid-March. The company has since

reopened stores in China and elsewhere such as South Korea,

although U.S. stores remain closed.

After the virus hit the U.S., Apple donated 20 million masks to

health-care workers and partnered with Google to create software

that enables smartphones to help track the spread of the virus.

The company this month added the $399 iPhone SE to its lineup,

its lowest-priced model since 2018 when it discontinued a previous

low-end model bearing the same name. The phone, which had been in

development long before the pandemic, now offers iPhone owners a

more affordable upgrade option at a time when many are being

pinched by economic troubles. It arrived less than six months after

Apple lowered the price of its most popular iPhone model by $50,

countering years of price increases and helping fuel a rebound in

sales during the December quarter.

The Wall Street Journal reported Monday that Apple is pushing

production of this year's flagship iPhones back by a month, which

could delay sales of those devices from September until October or

later. It also is cutting production volume for the four new models

by about 20% as the coronavirus weakens consumer demand.

Despite the production challenges, Apple managed to release new

devices, including an updated MacBook Air and iPad Pro in mid-March

that helped bolster those businesses in the quarter. Mac sales fell

3% to $5.35 billion, while iPad sales fell 10% to $4.37

billion.

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

April 30, 2020 17:45 ET (21:45 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

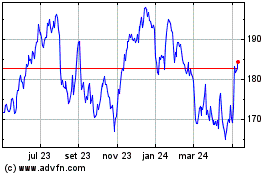

Apple (NASDAQ:AAPL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

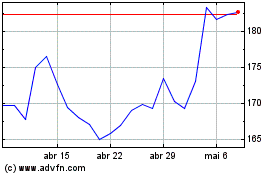

Apple (NASDAQ:AAPL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024