By Mike Colias

Ford Motor Co. executives tried to reassure investors Thursday

the auto maker was on track with a plan to lift its beaten-down

stock price, as a halting restructuring effort that began nearly

two years ago has been complicated by the Covid-19 pandemic.

Executives told investors during a webcast of its annual meeting

annual meeting that 2019's results fell short of goals, in part

because of unexpectedly high warranty costs and a troubled rollout

of a redesigned Explorer sport-utility vehicle.

They said the company is belt-tightening while preserving

capital for key programs, including a revamped F-150 pickup truck

and several new electric models in the works.

"We feel very good about our plan," said Ford Executive Chairman

Bill Ford Jr. "Look, management's compensation is heavily tied to

our stock, so it's in everyone's interest to get our stock price

back up."

Ford's shares have fallen 49% this year through Wednesday,

compared with a 42% drop in an index that tracks the auto sector,

and lagging behind rival General Motors Co., which has seen its

stock drop 41%. Ford shares closed Wednesday at $4.72, near their

lowest levels since 2009. Ford shares rose about 1% in midday

trading on Thursday.

Shareholders, who were asked to submit questions electronically,

pressed company leaders about the lagging stock price and wanted to

know whether Ford would restore its dividend, which it cut in March

to save about $2.4 billion annually.

Executives said they expect the dividend to be restored

eventually but didn't set a timetable.

Even before the pandemic knocked out most of the company's

factories for many weeks, Ford was struggling to show results from

a continuing turnaround effort initiated by Chief Executive Jim

Hackett in 2018.

The auto maker's operating profit has declined for three

straight years since Mr. Hackett, a former office-furniture CEO

handpicked by Mr. Ford to run the company, was appointed to the top

spot three years ago.

Now, Ford is in the midst of a multiyear restructuring that is

expected to siphon nearly $6 billion in cash as the auto maker

navigates the pandemic and a murky global outlook for auto

sales.

Mr. Ford, the company's chairman since 1999, has long maintained

a high profile at Ford. He has been the face of the company on

everything from a new electric Mustang SUV introduced last year to

Ford's entry into ventilator production for Covid-19 patients.

In recent years, he has amassed a larger share of the Ford

family's investment in the auto maker, increasing control of a

special supervoting stock held by descendants of founder Henry

Ford. The special Class B shares give the Ford family 40% voting

power and effective control of the company.

As of February, Mr. Ford, great grandson of the founder, held

20% of the company's Class B shares, according to a regulatory

filing. That percentage matched that of a year earlier, but has

steadily grown from 11.6% in 2014.

A company spokesman said Mr. Ford has increased his stake in the

supervoting stock by swapping his own common stock for Class B

shares of fellow family members. The Ford family must maintain a

minimum threshold of shares to keep 40% control.

Mr. Ford has recently snapped up common shares, too. Last

August, he acquired about 841,000 shares of common stock, the value

of which has since halved, to about $4 million.

Jim Farley, who in February was elevated to a vacant chief

operating role and is a potential successor to the 65-year-old Mr.

Hackett, also is betting on a share turnaround. On April 30 he

acquired $1 million worth of stock, among the largest open-market

stock purchases by a Ford insider in the past decade, the company

said.

Still, there is more reason for shareholder angst this year than

in recent memory.

Some investors expressed their discontent by voting to abolish

Ford's Class B supervoting stock. A shareholder proposal to end the

dual-class stock structure, in place since Ford shares began

publicly trading in 1956, got 35% of total share votes, according

to preliminary results released by the company.

In recent years, the percentage of investors voting to do away

with the Class B shares has hovered around that 35% mark.

The company argues in its proxy statement that the family's

stewardship provides a long-term perspective and loyal investor

base during crises.

Mr. Ford, who turned 63 this month and still plays ice hockey,

has said nonfamily shareholders benefit from the family's long-term

commitment to the company and his personal interest in seeing it

succeed.

"They know there is going to be someone there through thick and

thin, who isn't going to take a golden parachute and run

somewhere," he has said.

His 32-year-old daughter, Alexandra Ford English, is the latest

family member to ascend Ford's ranks, recently named

corporate-strategy director and taking Ford's board seat on startup

electric-truck maker Rivian Automotive.

Write to Mike Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

May 14, 2020 12:29 ET (16:29 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

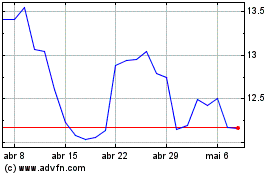

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

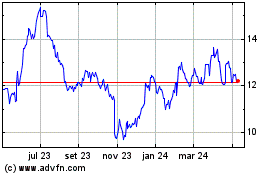

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024