Hong Kong Stocks Tumble, Leading Regional Markets Lower -- Update

22 Maio 2020 - 3:22AM

Dow Jones News

By Chong Koh Ping

Hong Kong shares plunged, leading regional declines, after China

signaled it will impose new national-security laws on the city.

By early afternoon Friday in Hong Kong, the Hang Seng Index had

lost 5.6%, with property, financial and infrastructure stocks

retreating between 5% and 9%.

The Hang Seng's decline put it on course for its worst day since

July 2015, Refinitiv Datastream data showed. Its biggest drop

during the market turmoil earlier this year came on March 23, when

it fell 4.9%. HSBC Holdings PLC dropped 4.7% on Friday, broadly in

line with the wider pullback.

Other major stock benchmarks in the Asia-Pacific region dropped

less steeply, tracking U.S. declines on Thursday. Japan's Nikkei

225 and Australia's benchmark S&P/ASX 200 traded 0.9% lower.

South Korea's Kospi Composite and the Shanghai Composite fell 1.6%

and 2% respectively.

E-mini S&P 500 futures fell 0.8%.

New security restrictions could further undermine the

Western-style rule of law and freedoms that have underpinned Hong

Kong's role as a global financial center.

President Trump said details on Beijing's plans aren't yet known

and promised to "address that issue very strongly" if China

proceeds. U.S. senators said they were introducing a bipartisan

bill that would sanction Chinese officials and entities who enforce

the new national-security laws in Hong Kong, and penalize banks

that do business with the entities.

Jim McCafferty, joint head of Asia-Pacific equity research at

Nomura in Hong Kong, said the coronavirus pandemic meant the city

had been relatively quiet in recent months after months of

antigovernment protests.

"Any attempts by China to become more assertive will cause some

flashpoints locally," he said, and could help stoke broader

geopolitical tension.

Ankit Khandelwal, chief investment officer at Maitri Asset

Management, said markets were caught between poor economic data and

U.S.-China tensions on one side, and governments' economic support

measures on the other. "The tension between the U.S. and China

might dictate the near-term movements of the markets," he said.

On Friday, Chinese Premier Li Keqiang, speaking at the opening

of an annual gathering of lawmakers, said the government wouldn't

set an economic target for 2020, pointing to the coronavirus and

uncertainties around trade.

Mr. Li detailed bond programs totaling 4.75 trillion yuan ($667

billion) to help fund China's recovery from the coronavirus. The

proceeds will be channeled to local governments to help boost

employment, consumption and investment.

"This is very different from in the past," when Chinese stimulus

didn't go directly into local governments' coffers, said Chaoping

Zhu, a Shanghai-based global market strategist at J.P. Morgan Asset

Management. "This means there will be more money to support local

employment and livelihoods and to support the local economy."

However, Mr. Zhu said the measures had disappointed some Chinese

investors, since it meant less capital would flow into shares and

property. "The government is not in a hurry to have a new round of

very aggressive stimulus measures. Pumping in a lot of money will

cause property prices to rise sharply again," he said.

The yield on the 10-year U.S. Treasury note fell to 0.650% on

Friday in Asia, from 0.677%. Yields move inversely to bond

prices.

Brent crude, the global oil benchmark, fell 3.8% to $34.68 a

barrel.

Write to Chong Koh Ping at chong.kohping@wsj.com

(END) Dow Jones Newswires

May 22, 2020 02:07 ET (06:07 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

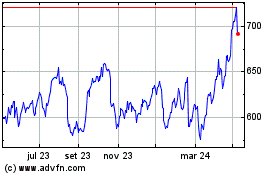

Hsbc (LSE:HSBA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

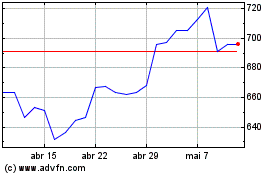

Hsbc (LSE:HSBA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024