Auto Makers Grapple With Worker No-Shows as Covid-19 Cases Surge

14 Julho 2020 - 3:29PM

Dow Jones News

By Ben Foldy

General Motors Co. and Ford Motor Co. are continuing to struggle

with keeping workers on the job as coronavirus cases surge

nationwide, forcing the auto-making giants to cut shifts, hire new

workers and transfer others to fill vacant roles.

The absences are hampering efforts to recover from the economic

havoc wreaked by the pandemic and return to normal production

levels after a nearly two-month shutdown this spring.

A GM assembly plant in Wentzville, Mo., that has been running

three shifts to restock the company's depleted supply of midsize

pickups is cutting one of the shifts to better cope with worker

absences, the company said.

The plant, normally staffed with around 3,800 hourly workers

split across the three shifts, will temporarily eliminate the third

one next week. Instead, the company will try to use workers from

that shift to fill absences along the assembly line in the first

two, the company said.

"In the short term, a two shift operating plan will allow us to

operate as efficiently as possible and accommodate team members who

are not reporting to work due to concerns about Covid-19," a

company spokesman said in an email, referring to the disease caused

by the coronavirus.

Ford also has been contending with an increase in absences among

the 12,500 or so hourly workers split across its two assembly

plants in Louisville, Ky., according to the company.

The auto industry is among several sectors, from retailers to

meatpacking plants, confronted by staffing shortfalls as positive

cases and safety concerns keep workers home. Companies invested in

safety measures to get production back to normal levels only to be

met by new waves of cases that threaten to set those efforts

back.

Outbreaks of Covid-19 in parts of the U.S. and abroad have led

to delays and even rollbacks of reopening plans. Authorities in

California on Monday ordered an immediate halt to indoor activities

in restaurants, bars, museums, zoos and movie theaters. Also

Monday, Walt Disney Co. said it would again close the Hong Kong

Disneyland theme park, less than a month after it reopened, after a

new surge of coronavirus cases struck the city.

In Louisville, rather than cut shifts, Ford has hired more than

1,000 new temporary workers since May across the two plants,

according to Todd Dunn, president of the local United Auto Workers

chapter representing the employees at the plants.

The new employees have been crucial to keeping up output, said

Mr. Dunn. "We would definitely have lost production, period," he

said.

Ford confirmed it has hired more workers to keep production

levels at or near full capacity, a spokeswoman said.

The UAW is monitoring the situation and working with the

companies to deal with the rise in absences while protecting

members' health and safety, a spokesman said.

Workers at the GM plant said that each of its three shifts have

been running with absences in the hundreds, curtailing production

of trucks and vans.

St. Charles County, where the plant is located, has seen a jump

in new confirmed cases of Covid-19 over the past few weeks amid a

broader surge in parts of the country, according to data from the

U.S. Covid Atlas, a coronavirus-surveillance effort run by

researchers at several institutions.

Around two dozen people working in the GM plant have tested

positive for the virus since the plant restarted in May, union

officials said.

In March, GM, Ford and other auto makers halted nearly all their

U.S. production amid rising case counts and orders from local

governments to curb nonessential economic activity. During a

stoppage that lasted nearly two months, auto makers developed new

safety protocols and worked with the UAW on how to manage the

pandemic in the plants.

Since coming back online in mid-May, plants have struggled with

supply-chain disruptions, temporary shutdowns caused by new

positive cases and worker absences. At some plants, workers have

requested the plants be closed after positive cases.

Keeping the plants staffed and running has been a challenge, Mr.

Dunn said. "When they said it was a pandemic, it sure as hell

didn't sound like it was going to be easy," he said. "It's just

really severe working conditions."

(END) Dow Jones Newswires

July 14, 2020 14:14 ET (18:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

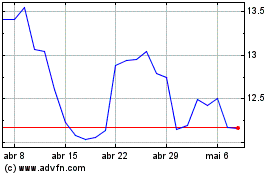

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

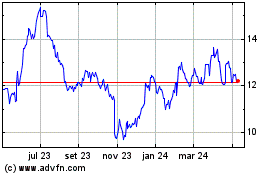

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024