Supply Cuts Boost Canadian Oil Producers

21 Julho 2020 - 6:59AM

Dow Jones News

By Vipal Monga

TORONTO -- Aggressive cuts by Canadian oil producers in the

spring are starting to pay off in the summer.

After coronavirus-related shutdowns stalled business, U.S. oil

refiners have started making more gasoline for drivers who are

returning to the road. That has increased demand for Canadian oil,

which is the largest source of crude for Midwestern refineries.

Though the recovery is still nascent and remains fragile, it is

an improvement from March.

Then, amid a global supply glut and pandemic-related slowdowns,

oil prices plunged, and companies such as Calgary-based Suncor

Energy Inc., Cenovus Energy Inc. and Husky Energy Inc. decided to

shut down wells because they had few places to sell their oil

profitably.

Canada's oil industry, the world's fourth-largest crude

producer, was hard hit by the pandemic because it is almost

entirely dependent on the U.S. as an export market. As the U.S.

economy froze, many Canadian producers eased production, cut

spending, stopped share buybacks or shaved dividends.

Now, they are sounding a more optimistic tone.

"They're coming out of the other side of this in decent shape,"

said Matt Murphy, an analyst with Tudor Pickering Holt & Co. in

Calgary. "I think in hindsight it will have been a fairly smart

decision to cut production."

Canadian producers in May cut average petroleum production by

1.3 million barrels a day more than February levels, according to

the U.S. Energy Information Administration. May's production of 4.4

million barrels a day was 20% lower than average monthly production

in 2019. It was also the lowest since mid-2016, when wildfires

burned through large portions of the Canadian oil sands and many

oil fields shut down.

The shut-in strategy has helped. A combination of rising demand

and limited supply has shrunk crude-oil inventories, which were

threatening to swamp available storage during the spring

lockdowns.

The inventory in Western Canada totaled 28.6 million barrels as

of June 26, down 214,000 from June 5, according to data provider

Genscape. At the beginning of March, inventories totaled almost 31

million barrels.

In the U.S., by contrast, supply continues to exceed demand.

Crude inventories rose slightly from May to a record 538.8 million

barrels at the end of June, according to the American Petroleum

Institute.

Refiners in the U.S. Midwest are geared toward processing the

thicker crude that Canada exports and are willing to pay up for

scarce supply, said Mr. Murphy. That is brightening Canadian

producers' outlook.

Exxon Mobil-owned Imperial Oil Ltd., which has three refineries

in Canada that supply Canadian and U.S. markets, has been

processing more gasoline and diesel fuel as economies have eased

their Covid-19-related shutdowns, said Chief Executive Brad Corson,

at a July energy conference. "If we continue on the path we're on,

I feel quite optimistic," he said.

Western Canadian Select crude oil was selling for $31.68 a

barrel on Monday, according to S&P Global Platts, $9.45 lower

than the U.S. benchmark grade West Texas Intermediate. The thicker

Canadian oil trades at a discount to the U.S. benchmark because it

is more difficult to refine and needs to travel farther to get to

market. The differential had narrowed from roughly $23 in

January.

Canadian producers pay operating costs as high as $25 a barrel,

so oil prices in the $30 range mean many are cash-flow positive and

should be bringing more production back on line, said Platts

analyst Parker Fawcett.

There are already signs of increased drilling in Canada's oil

patch. The number of oil-drilling rigs for the week ended July 17

rose by six to 32, according to oil-service company Baker Hughes.

Though the number is down 86 from the same time a year earlier, the

weekly increase suggests that demand is picking up. In the U.S., on

the other hand, the rig count fell by five in that week.

Calgary-based Cenovus, which shut in roughly 60,000 barrels a

day of production in March, has since resumed production of most of

the shut-in crude, said CEO Alex Pourbaix at a TD Securities energy

conference earlier this month.

"We are seeing a strong price signal to bring those barrels back

on," said Mr. Pourbaix.

Write to Vipal Monga at vipal.monga@wsj.com

(END) Dow Jones Newswires

July 21, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

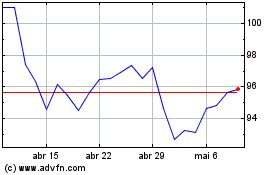

Imperial Oil (TSX:IMO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Imperial Oil (TSX:IMO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024