Gucci's Sales Fell 34% in First Half

28 Julho 2020 - 5:03PM

Dow Jones News

By Matthew Dalton

PARIS -- Gucci's sales and operating profit fell sharply in the

first half, hit hard by lockdowns imposed world-wide to fight the

coronavirus pandemic.

The Italian fashion house appeared to lose market share against

two of its main rivals, Louis Vuitton and Dior, the French luxury

brands owned by LVMH Moët Hennessy Louis Vuitton. Gucci's revenue

fell 34% to EUR3.1 billion ($3.6 billion) in the half, its parent

company, the Paris-based Kering SA, reported Tuesday. Sales at

LVMH's fashion and leather goods division -- the bulk of which is

Louis Vuitton and Dior -- were down just 23% in the half.

Gucci's operating profit slid 51% to EUR929 million.

Gucci has been struggling over the past year with slowing

momentum, after three years of breakneck growth under its creative

director Alessandro Michele. Mr. Michele's more recent fashion

shows have displayed a less eclectic aesthetic than the one that

propelled the brand in years past, when he mixed

professional-sports logos with Renaissance-era silhouettes and sent

models down the runway carrying replicas of their own heads.

The Italian fashion house, however, was better able to control

costs in the first half than its French rivals, as lockdowns

imposed during the pandemic forced boutiques around the world to

shut for months at a time. That is partly because, unlike LVMH,

Gucci relies heavily on third-party production from a network of

small manufacturers clustered around Gucci's headquarters in the

Florence region.

The structure makes it easier for Gucci to cut costs by

canceling orders to these suppliers. Louis Vuitton and Dior own

most of the factories that produce their goods.

"The fact that we are less internalized in production does

help," said Jean-Marc Duplaix, Kering's chief financial officer.

"Sometimes it can be a weakness and sometimes it's a strength."

Gucci, however, has been moving to take control of more of its

production by buying up suppliers and building new factories. The

goal is to be able to bring new products to market faster and

ensure that it has enough production to meet surging demand for

leather goods and other luxury products -- assuming demand does

recover after the pandemic. Mr. Duplaix said the economic crisis

hasn't prompted Kering to reconsider that strategy.

Overall sales at Kering, which also owns Saint Laurent,

Balenciaga and Bottega Veneta, fell 30% to EUR5.4 billion, while

net income was EUR273 million. Recurring net profit fell 53%, far

less than at LVMH.

The quarter displayed another strong performance from Bottega

Veneta, which until recently was Kering's worst-performing brand.

The brand, known for its handbags made with the intrecciato weaving

technique, replaced its longtime creative director in 2018 with the

young British designer Daniel Lee.

First-half sales at Bottega Veneta were down 8.4%.

Write to Matthew Dalton at Matthew.Dalton@wsj.com

(END) Dow Jones Newswires

July 28, 2020 15:48 ET (19:48 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

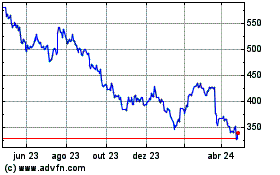

Kering (EU:KER)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

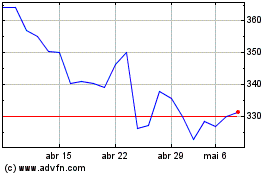

Kering (EU:KER)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024