Siemens Ally Buys Cancer Specialist -- WSJ

03 Agosto 2020 - 4:02AM

Dow Jones News

By Tom Fairless

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 3, 2020).

FRANKFURT -- Siemens Healthineers AG, a medical technology

spinoff of the German conglomerate, said it would acquire

U.S.-based Varian Medical Systems Inc. for $16.4 billion, roughly

25% above its current market value.

The deal will create a world leader in the area of cancer

therapy, Siemens deputy CEO Roland Busch said in a statement

Sunday.

Varian, based in Palo Alto, Calif., specializes in cancer

treatments including radiation therapy and related software. It has

around 10,000 employees globally and revenue of $3.2 billion in

fiscal 2019, Siemens said.

The conglomerate said its stake in Siemens Healthineers, based

in Erlangen, Bavaria, would fall to about 72% from 85% as a result

of a capital increase to fund the deal, in which Siemens won't

participate. Siemens had spun off its medical technology unit in

2018.

"A transformational step of this kind wouldn't have been

possible in the conglomerate structure of the old Siemens AG,"

Siemens President and CEO Joe Kaeser said in a statement.

The deal, to be financed through a capital increase and new

debt, is expected to close in the first half of 2021, subject to

approval by Varian shareholders and regulatory approvals, Siemens

said.

Siemens said it would "remain a strong majority shareholder and

thus profit from the company's considerably expanded setup."

Write to Tom Fairless at tom.fairless@wsj.com

(END) Dow Jones Newswires

August 03, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

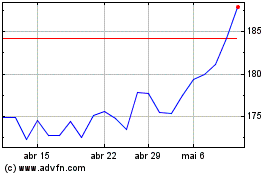

Siemens (TG:SIE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Siemens (TG:SIE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024