Société Générale Retreats From Risky Investments -- WSJ

04 Agosto 2020 - 4:02AM

Dow Jones News

By Pietro Lombardi and Patricia Kowsmann

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 4, 2020).

French banking giant Société Générale SA, stung by

coronavirus-related trading losses earlier this year, plans a

retreat in its investment-banking unit and posted a surprise loss

Monday, even as rivals thrived on the increase in stock and bond

trading.

While competitors such as Goldman Sachs Group Inc. and Morgan

Stanley have gained from customers moving their investments around

to adapt to market shifts under the pandemic, Société Générale took

losses in one of its specialties, creating and selling complex

investment products.

The bank on Monday reported a EUR1.26 billion ($1.48 billion)

net loss for the second quarter, compared with a profit of EUR1.05

billion in the same period a year earlier. Much of the loss was

related to EUR1.33 billion in charges related to the reduction in

value of its investment-banking business and deferred-tax assets

that it no longer expects to recover.

Net banking income, the bank's top-line revenue figure, fell

almost 16% to EUR5.3 billion. Analysts had forecast a small profit

and slightly higher revenue.

Revenue from equities trading fell 80% in the from the

year-earlier period, trailing rivals who showed gains in revenue or

more modest declines.

Société Générale, in addition to being a major French retail

bank, concentrates on producing and trading complex derivatives

related to the stock market. It took major losses in the first

quarter when the market panic related to the coronavirus pandemic

upended trades in that business.

The bank said it had concluded a review and will cut back on

risk-taking in such structured products tied to the performance of

stocks and bonds. Lower risk-taking at its trading operations will

mean it will be less likely to lose money when markets are

dislocated. But it will also result in a revenue decline of between

EUR200 million and EUR250 million, it said. It plans to counter the

fall with cost cuts worth some EUR450 million by 2022-23.

"The group will continue to adapt its activities to the new

post-Covid crisis environment, extending in particular the efforts

to reduce costs, " Société Générale's Chief Executive Frédéric

Oudéa said. Overall costs were down 10% in the second quarter.

Investment products tied to those structured trades promise

investors high returns when markets are calm, and generate strong

fees for the bank. But the wild and violent swings in markets in

March and April left the bank exposed.

Société Générale has suffered most because companies canceled

dividend payments to save money. Some of Société Générale's

structured products are tied to shareholder payouts.

The bank had been among the worst-performing major bank stocks

in Europe this year. Shares have fallen almost 60% since the

beginning of the year and were down 2% Monday. Investors are deeply

skeptical of its ability to generate profits and avoid trading

losses. Its shares are valued at just 16% of book value, compared

with 44% for rival BNP Paribas SA and 124% for JPMorgan Chase &

Co.

BNP Paribas, which also sells complex structured products to

customers, reported strong second-quarter profits last week,

attributing it to a diversified business model.

Mr. Oudéa said Société Générale has designed a new range of

products for clients that will be less risky for the bank, but

added it wants to retain its market share in equity structured

products. He said business improved in the second half of the

quarter when there was a rebound in activities from mid-May.

Like other European banks, Société Générale took substantial

provisions for soured loans, as the impact of the coronavirus

shutdowns rippled through the economy. It stowed away EUR1.28

billion for provisions, up from EUR314 million a year earlier.

Bank officials, however, said retail activity was back to normal

in June after falling sharply during the lockdown in France.

Write to Pietro Lombardi at Pietro.Lombardi@dowjones.com and

Patricia Kowsmann at patricia.kowsmann@wsj.com

(END) Dow Jones Newswires

August 04, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

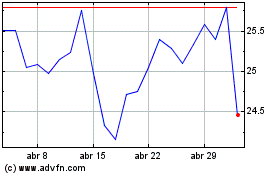

Societe Generale (EU:GLE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

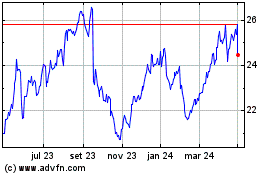

Societe Generale (EU:GLE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024