By Mike Colias

Ford Motor Co.'s Chief Operating Officer Jim Farley will take

over as chief executive, succeeding the retiring Jim Hackett, who

is more than three years into a turnaround effort that has yet to

lift profits or the auto maker's depressed share price.

The company said Tuesday Mr. Farley, 58 years old, will succeed

Mr. Hackett, 65, on Oct. 1. Mr. Hackett will remain in an advisory

role through next spring, the company said.

Ford was already struggling to revamp its money-losing overseas

operations when the coronavirus pandemic forced auto makers to shut

down their factories, sending Ford scrambling to borrow money as it

burned through billions of dollars in cash. Ford's factories have

recovered nearly to prepandemic levels and the company last week

signaled a third-quarter profit.

Mr. Farley emerged in February as the leading contender to take

over, when the former strategy chief and longtime marketing

executive was elevated into the chief operating officer role. His

promotion coincided with the sudden retirement of Ford's president

of automotive, Joe Hinrichs, who essentially had been serving as a

co-No. 2 with Mr. Farley in what many viewed as a competition for

the top job.

Ford Executive Chairman Bill Ford Jr. said the CEO change has

been planned for some time. He lauded Mr. Hackett for revamping

Ford's vehicle lineup, in part by shedding unprofitable sedans, and

taking on a major revamp of Ford's business outside the U.S.

through a continuing, multibillion-dollar restructuring.

"It's my belief that he still doesn't get enough for taking on

the tough issues," Mr. Ford said during a media conference call

Tuesday. He also described Mr. Farley as a "car guy" who

understands the technological shifts disrupting the car business,

from driverless cars to the influx of digital services into the

cockpit.

Ford's stock was up 1.8% in midmorning trading, to $6.82.

Mr. Hackett, a former office-furniture CEO who had no

auto-industry experience before arriving at Ford, was appointed CEO

in May 2017. At the time, Mr. Ford praised him as a change agent

who could guide the company's long-range strategy in an industry

buffeted by disruption, from big bets on electric and driverless

cars to incursions by tech giants looking to take more control of

the car's cockpit.

But beyond mapping the future, Mr. Hackett has grappled with

more-pressing problems in Ford's manufacturing business today that

continue to weigh on profits.

Troubles have popped up in Ford's U.S. business, its main profit

generator. The company stumbled last year on the first redesigned

Explorer SUV in nearly a decade, one of the auto maker's most

important vehicle launches in years. Quality problems on certain

models also have led to higher warranty costs, which swelled to

around $5 billion, roughly 30% higher than past years, Mr. Farley

told analysts in February.

Ford's operating profit has fallen for three straight years,

including a 9% drop in 2019, to $6.38 billion, a year in which

executives at one point thought they would increase earnings. Mr.

Hackett said in February that he was disappointed in the 2019

results, after having signaled that was the year Ford would reverse

the earnings slide.

The Dearborn, Mich., auto maker's results have contrast with

rival General Motors Co., which has posted better profit margins

and shown greater earnings resilience during the pandemic. In the

second-quarter, GM breezed past analysts' expectations, reporting a

$589 million operating profit for the April-to-June period, while

Ford posted an operating loss of $1.9 billion.

Investors have punished Ford in the wake of the disappointing

results. Shares had been hovering around a decade-low before the

pandemic sent them down further, though they have rallied about 67%

since the spring, to $6.69 at Monday's close. They have fallen 40%

during Mr. Hackett's tenure.

To combat losses overseas, Ford is in the early stages of a

multiyear, $11 billion restructuring that includes closing plants

and shedding workers in Europe and Latin America. Mr. Hackett has

shuffled his executive team in China, where Ford's sales have

cratered more than 60% from their peak a few years ago,

transforming years of steady profit into losses.

Mr. Hackett, a former University of Michigan football player who

also served as the school's interim athletic director last decade,

has at times frustrated investors and analysts, some of whom

complained that his turnaround was taking too long to develop.

More than a decade ago, Mr. Ford and the board turned outside

the company to steer Ford out of one of its darkest hours by hiring

former Boeing Co. Chief Executive Alan Mulally, who helped the auto

maker avoid the bankruptcy fate suffered by its closest rivals, GM

and Chrysler Corp.

Over an eight-year tenure, Mr. Mulally improved profitability in

part by shedding brands and simplifying Ford's vehicle lineup,

while rallying employees around a "One Ford" mantra aimed at

stitching together the company's fractured corporate culture.

Ford has struggled to find its footing since Mr. Mulally's 2014

departure. His successor was Mark Fields, who recorded a few years

of heady profits but was pushed out in part because the board felt

he wasn't moving fast enough to position Ford for the changes

buffeting the car business, people familiar with the move have

said.

At the time, Mr. Ford stressed the need for swift action, and

drew parallels between Messrs. Hackett and Mulally, and said Mr.

Hackett, who ran office-furniture maker Steelcase Inc. for about

two decades before retiring, could "capture the hearts and minds of

our employees."

Mr. Hackett has touted a "redesign" of Ford's business. Last

year, the company eliminated layers of management -- including

several hundred salaried U.S. job cuts -- a process aimed at

speeding up the company's decision-making and vehicle

development.

To lift profitability, Ford in 2018 decided to drop almost all

of its passenger-car lines in the U.S. to focus investment on

more-profitable trucks and SUVs.

Mr. Hackett also has pushed Ford into potential growth areas, as

technology advances and consumers seek alternative ways of getting

around that are de-emphasizing the vehicle-ownership business

model. Ford is investing in driverless-vehicle technology with an

emphasis on the commercial market, including tests of autonomous

pizza and flower delivery, for example.

But some Ford executives and employees have struggled with Mr.

Hackett's cerebral style, which includes a heavy dose of design

thinking, a practice that attempts to solve problems by getting

into the mind of the consumer.

Last year, internal employee-survey results showed just 47% of

respondents felt top management at Ford was giving employees a

clear picture of the company's direction, down from 81% in

2016.

Mr. Farley joined Ford in 2007 as a marketing executive from

Toyota Motor Corp. He has said he was drawn to Ford in part because

of deep family roots -- his grandfather joined the company in

1913.

He served as Ford's marketing chief for many years before

overseeing a turnaround effort in Europe from 2015 to 2017. Over

the past three years, he served as head of strategy and oversaw

Ford's global businesses before getting promoted into the

chief-operating role.

Mr. Farley said he wants to increase Ford's profit margins,

especially in the lucrative North American market. He cited a

pressing need to fix inflated warranty costs, which have risen in

recent years from costly vehicle recalls. He also said he wants to

expand Ford's business of selling trucks and vans to commercial

customers, an area the company dominates.

"We're committing to develop a very specific plan," Mr. Farley

said during Tuesday's call.

Write to Mike Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

August 04, 2020 11:44 ET (15:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

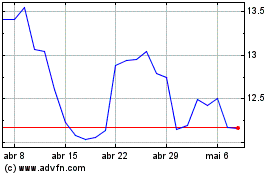

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

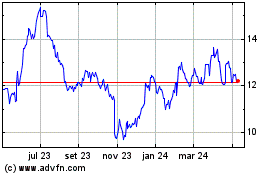

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024