Buyout Deal for AXA's European Unit Collapses -- WSJ

07 Agosto 2020 - 4:02AM

Dow Jones News

By William Louch

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 7, 2020).

U.K. private-equity firm Cinven's planned purchase of a unit of

French insurance company AXA SA has collapsed, the latest example

of how the coronavirus pandemic has stymied deal making.

AXA said Thursday that an agreement it struck to sell its AXA

Life Europe business to Cinven had been terminated after failing to

meet certain conditions.

A source close to the deal said that the two parties were unable

to bridge the gap between their expectations on the unit's

valuation, particularly after the Covid-19 pandemic hit.

The announcement ends negotiations that date back to Aug. 1,

2018, when AXA disclosed it had received an offer from Cinven for

the unit. The private-equity firm initially agreed to pay EUR925

million ($1.01 billion)) for shares in AXA Life Europe with a

subsequent distribution of EUR240 million by the unit to AXA before

the deal closed.

AXA Life Europe is a specialized platform that designs,

manufactures and distributes AXA's variable annuity products across

Europe.

The transaction's demise is the latest example of how the

pandemic has hampered private-equity deal making across the globe.

Private-equity firms world-wide announced $180 billion in

acquisitions in the first half, 36% less than the first half of

2019, according to a report released late last month by Ernst &

Young Global Ltd.

Activity has been depressed by several factors, including a lack

of debt financing and a mismatch in pricing expectations between

buyers and sellers.

A handful of deals that had already been agreed to have been

canceled or renegotiated at lower prices. In May, U.S.

private-equity firm Sycamore Partners and Victoria's Secret owner L

Brands Inc. agreed to scrap a deal for the lingerie retailer.

Last month, meanwhile, cybersecurity company Forescout

Technologies Inc. agreed to a revised deal with private-equity firm

Advent International Corp. at a price that was around 12% lower

than the $33 a share Advent originally said it would pay in

February.

AXA said in a statement Thursday that it is continuing to review

strategic options with regard to the AXA Life Europe unit it had

agreed to sell to Cinven.

The Paris-based company, one of Europe's largest insurance

groups, saw earnings fall by 48% to EUR1.9 billion through the

first six months, with the fall driven largely by claims related to

the pandemic.

Cinven is one of Europe's best-known private-equity groups and

is currently investing from a EUR10 billion fund that it closed

last year. Last week, the firm announced it had completed its

EUR17.2 billion acquisition of Thyssenkrupp AG's elevator division,

which it bought as part of a consortium that included Advent.

Write to William Louch at william.louch@wsj.com

(END) Dow Jones Newswires

August 07, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

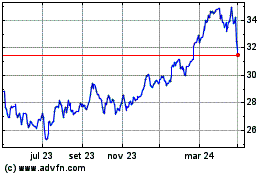

Axa (EU:CS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

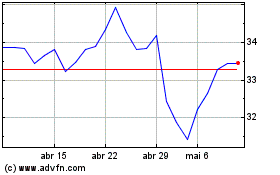

Axa (EU:CS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024