By David Winning

SYDNEY-- Rio Tinto PLC's next leader will inherit a decision

that could define the miner's next decade: whether to partner with

China on a potentially lucrative but costly African project that

could reshape the iron-ore market.

That decision adds to a list of challenges for the successor to

Jean-Sébastien Jacques, who was forced out after Rio Tinto

destroyed two ancient rock shelters at Juukan Gorge in Australia in

May.

The iron ore buried in Guinea's Simandou mountains is among the

world's largest untapped deposits of the commodity. Its riches have

long been coveted by global miners and investors competing to

exploit booming demand for a commodity used to make steel.

Chinese companies are pushing hard to develop Simandou after a

consortium including a unit of aluminum maker China Hongqiao Group

Ltd. and port operator Yantai Port Group Co. secured rights to mine

the northern half of the deposit in a $14 billion tender late last

year. Rio Tinto and partners own the southern half, but they could

save billions of dollars in construction costs if they

collaborate.

Rio Tinto's decision boils down to whether it wants to be

involved in a project that could put pressure on iron-ore prices by

increasing global supply of the commodity. A 2014 study by the

company put the cost of developing the southern half of Simandou at

$20 billion. Political risk in West Africa is also high.

Still, Simandou's iron ore is likely too valuable to remain in

the ground. China consumes around one billion tons of the commodity

every year, mostly imports from Australia. A development in Guinea

would boost the security of China's supply, especially for

high-grade ore that is typically less polluting when turned into

steel.

"It's an awkward one for Rio Tinto," said Paul McTaggart, a

Sydney-based resources analyst at Citi. "It either participates in

the development of Simandou, and it puts pressure on iron-ore

prices, or it doesn't participate and they have an iron-ore asset

that's worth nothing."

Rio Tinto once saw Simandou as central to its ambitions to

become the world's top iron-ore producer after winning the rights

to mine a 300-square-mile area in 2006. But those plans soon

foundered in a country with few skilled workers and poor

infrastructure. Exporting the iron ore would have required spending

billions of dollars to build a cross-country rail line and a deep

water shipping port.

In 2008, Guinea's government stunned the mining industry by

telling Rio Tinto it wasn't moving fast enough at Simandou and

stripped the company of rights to develop 50% of the deposit. In

2016, Rio Tinto dismissed two executives for their alleged role in

making $10.5 million in payments to a consultant in Guinea.

Scarred by the experience, Rio Tinto tried to get out of

Simandou. But the company's plan to sell its interest to

joint-venture partner Aluminum Corp. of China, known as Chinalco,

fell apart in 2018 when the deal didn't complete.

"We have always assumed that Simandou would happen," Jakob

Stausholm, Rio Tinto's chief financial officer, said in an

interview. "It has always been in our long-term forecasts, and

depending on the price of iron ore, there's space for

Simandou."

To make a decision on Simandou, Rio Tinto's next chief executive

will need to assess how quickly China's demand for steel will peak

as that would influence the country's appetite for iron ore. The

availability of scrap metal could also weaken demand. How

Simandou's returns measure up against other options to grow

production, including via acquisitions, will be another factor.

The company will have to assess the impact that Simandou's

supply would have on iron-ore prices, as it risks making Rio

Tinto's existing operations in Australia and Canada less

profitable. Australia accounts for more than 50% of the world's

trade in iron ore by sea.

"Simandou represents a major threat to long-term iron-ore

prices," possibly reducing them by more than 10%, said Lyndon

Fagan, analyst at J.P. Morgan Securities Australia Ltd.

Rio Tinto last month began a search for a successor to Mr.

Jacques, who will remain in his role no later than March 31. Some

analysts expect an external candidate will be chosen, as many

potential leaders left the miner in the past four years. In

addition to deciding Simandou, the new leader will have to rebuild

the miner's reputation following the caves' destruction, deal with

regulatory investigations in the U.S. and Australia, and oversee

the delayed expansion of a copper mine in Mongolia.

The speed at which the group that owns the northern half of

Simandou, SMB-Winning Consortium, is moving ahead has surprised

industry watchers. In June, Guinea's government signed a basic

agreement with SMB-Winning for the development of Simandou,

including the need for a 400-mile railway through mountains and

across marshy lowlands to the coast.

Goldman Sachs expects the consortium to start the railway's

construction next year if it can secure financing, and begin

producing iron ore about four years later. That narrows the window

for Rio Tinto to decide whether to collaborate, with Goldman

estimating that infrastructure sharing could cut combined

construction costs by up to $7 billion and boost returns for each

project by more than 3%.

Rio Tinto has signaled it is open to discussions on

infrastructure sharing. The company is working with Chinalco and

other partners to find ways to lower costs and speed up development

of Simandou's southern half.

"We believe it makes economic sense to build an infrastructure

system that can be shared," said Bold Baatar, chief executive of

Rio Tinto's energy and minerals division.

Singapore-based Winning International Group, which leads the

SMB-Winning Consortium, declined to comment on whether it would be

open to collaborating with Rio Tinto.

Write to David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

October 01, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

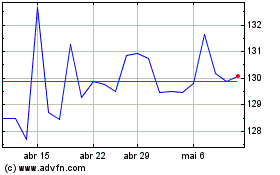

Rio Tinto (ASX:RIO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

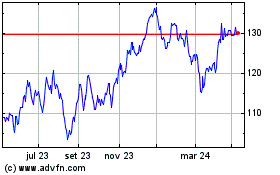

Rio Tinto (ASX:RIO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024