By Anna Hirtenstein and Paul Vigna

The Dow Jones Industrial Average dropped 650 points Monday as

coronavirus cases surged, adding to worries about the economic

outlook after Congress and the White House failed to agree on a

much-anticipated fiscal stimulus deal.

Major indexes opened lower, and declines accelerated into the

afternoon. In the Dow -- which suffered its steepest one-day point

and percentage drop since Sept. 3 -- 29 of 30 stocks fell on the

day. All 11 sectors of the S&P 500 also suffered losses.

Among the biggest decliners were the travel and leisure stocks

that have come under the most pressure this year during the

pandemic. Royal Caribbean Group dropped 9.6%, United Airlines

Holdings fell 7% and Marriott International declined 5.6%.

"The ability to fight the virus further right now is very much

in question, and it's a political question," said Steven Wieting,

chief strategist at Citi Private Bank. It could be months before

anything gets done in Washington, and that's made investors

tentative, he said.

The Dow fell 650.19 points, or 2.3%, to 27685.38, paring a

early-afternoon loss of as much as 965 points. Apple was the only

stock in the index to finish the day in the green, rising a

penny.

The S&P 500 lost 64.42 points, or 1.9%, to 3400.97. The

Nasdaq Composite dropped 189.34 points, or 1.6%, to 11358.94. All

three indexes are down more than 5% from their records earlier this

year.

The average number of new coronavirus cases reported daily over

the past week reached an all-time high of 68,767 on Monday.

Scientists had been expecting cooler weather to lead to a second

wave of the disease, but the swell is coming earlier than many had

anticipated. That is prompting fresh concerns about tighter

lockdown restrictions and the effect on the economy.

"It's a worrying picture for sure," said David Stubbs, head of

investment strategy at J.P. Morgan Private Bank. "But we always

knew this recovery would be stop-start: We won't be truly moving

into the main part of a new cycle until the health-care issue

itself is dealt with."

Meanwhile, the chances of a stimulus package coming together

before the election next Tuesday are looking increasingly slim, and

the possibility, if President Trump is defeated, of no additional

relief coming before late January is rising. Democrats and White

House officials have blamed each other for the lack of

progress.

A selloff here isn't surprising, said Esty Dwek, head of global

market strategy at Natixis Investment Managers. Last week the

market was optimistic about stimulus aid, and this week those hopes

have been leveled somewhat.

Moreover, some polls suggest key Senate races are tightening,

Ms. Dwek said, cutting into expectations of a takeover that would

allow Democrats to pass an aggressive stimulus package after the

election. "The blue wave might not be as much of a given," she

said.

Historically, the week before a presidential election is good

for stocks. Since 1928, the market has usually risen in the last

full week before the contest. The S&P 500 has been up in 70% of

those weeks, according to Dow Jones Market Data. The gains are even

more frequent if measured from the Tuesday before the election to

Election Day. The index has risen in 91% of those instances.

Investors are also still tuned in to third-quarter earnings

season. A heavy calendar this week includes Microsoft, Caterpillar,

Apple, Amazon.com, 3M, ConocoPhillips and Alphabet.

The critical element isn't necessarily the results themselves,

said Fawad Razaqzada, an analyst at ThinkMarkets, but the corporate

outlooks for the next few quarters. If executives start pointing to

weaker earnings growth and a slowing economy, it could cut into the

market's momentum, he said. "People are generally optimistic about

the future," he said. "This might be a reality check."

Corporate earnings are expected to turn a corner in the current

reporting season. Although profits are still expected to fall

sharply from a year earlier, analysts project a rebound from the

second quarter and a return to growth in 2021.

The beaten-down energy sector was the weakest performer in the

S&P 500 Monday, falling 3.5%. The industrials, materials,

communications services, financials and information technology

groups also fell more than 2%. Utilities were a relative bright

spot, dropping less than 0.1%.

Elsewhere, the pan-continental Stoxx Europe 600 retreated 1.8%,

led by a decline in German stocks. Coronavirus cases are

accelerating in Europe. France reported more than 52,000 new

infections Sunday, a daily high. Italy is trying to rein in the

spread with new rules, such as the mandatory closure of restaurants

and bars at 6 p.m. Spain declared a state of emergency, as it did

in March.

In Asia, most major equity benchmarks closed lower. China's

Shanghai Composite Index fell 0.8%. Markets in Hong Kong were

closed for a public holiday.

In other markets, U.S. crude oil futures fell 3.2% to $38.56 a

barrel. A cease-fire in Libya has led analysts to project the

country's output will reach 1 million barrels a day in the next

four weeks, up from about half a million a day, according to Bjarne

Schieldrop, chief commodities analyst at SEB. The rise in

coronavirus infections is also muting prospects for the economic

recovery and damping demand, he said.

In bond markets, the yield on the benchmark 10-year U.S.

Treasury note declined to 0.801%, from 0.840% Friday.

The WSJ Dollar Index, which measures the greenback against a

basket of currencies, added 0.3%.

Write to Anna Hirtenstein at anna.hirtenstein@wsj.com and Paul

Vigna at paul.vigna@wsj.com

(END) Dow Jones Newswires

October 26, 2020 17:24 ET (21:24 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

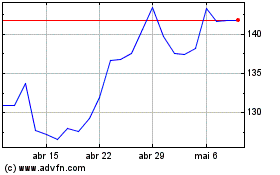

Royal Caribbean (NYSE:RCL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

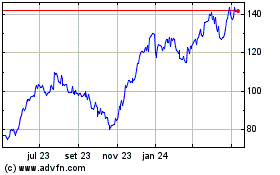

Royal Caribbean (NYSE:RCL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024