Heineken to 'Streamline' Offices as It Prepares for Volatility Ahead -- Update

28 Outubro 2020 - 7:06AM

Dow Jones News

--Heineken aims to reshape company in strategic review

--The company warned of continuing uncertainty as new

coronavirus wave hits Europe

--Third-quarter beer volumes beat expectations despite weakness

in Asia-Pacific

By Adria Calatayud

Heineken NV said Wednesday that it will "streamline" its head

office and regional offices to cut costs as it prepares for an

extended period of volatility and uncertainty due to the

coronavirus pandemic.

The Dutch brewer--which also owns the Sol, Birra Moretti and

Tiger beer brands--said the changes are part of a strategic review

that aims to reshape the company. Chief Executive Dolf van den

Brink, who replaced longtime Heineken boss Jean-Francois van

Boxmeer in June, said he wants Heineken to emerge stronger from the

pandemic.

The world's second-largest brewer said it is exploring how to

accelerate and expand its sources of growth while simplifying and

right-sizing its cost base. Separately on Wednesday, the company

said it will buy cider brand Strongbow from Asahi Group Holdings

Ltd. in Australia, and gain perpetual licenses on beer brands

Stella Artois and Beck's in Australia.

As a result of its office simplification, Heineken expects a

reduction of around 20% in related personal costs. Implementation

will begin in the first quarter of 2021, as the company had

committed to not launching restructurings related to Covid-19 in

2020.

Despite a partial recovery over the summer, Heineken warned of

continuing uncertainty due to a second wave of coronavirus

infections in Europe, and said recurring lockdowns and the lack of

international tourism in Asia-Pacific hurt its third-quarter

performance in a key growth engine.

"The situation remains highly volatile and uncertain. We expect

rolling outbreaks of Covid-19 to continue to meaningfully impact

many of our markets in addition to rising recessionary pressures,"

Mr. Van den Brink said.

Shares at 0910 GMT were down EUR2.76, or 3.5%, at EUR77.28.

For the first nine months of 2020, Heineken made a net profit of

396 million euros ($467.9 million), down from EUR1.67 billion a

year-earlier.

In the third quarter, organic consolidated beer volume fell

1.9%, against consensus expectations of a 5.9% decline. Heineken's

volumes were better than analysts had expected in Western Europe,

the Americas, and Africa, the Middle East and Eastern Europe, but

weaker than anticipated in Asia-Pacific.

In the U.S., Heineken said beer volumes returned to organic

growth in the quarter as distributors replenished inventories and

sales through bars and restaurants showed some signs of

recovery.

However, the company said the pandemic is having a significant

impact on its markets and wider business. Continued volatility is

expected for the fourth quarter, as many of its markets experience

additional waves and fresh restrictions, including bar and

restaurant closures, Heineken said.

Analysts currently expect Heineken to post a 7.7% decline in

organic beer volumes for the full year. For the first nine months

of the year, the company's organic beer volumes fell 8.1%,

following a 12% drop for the first half.

Heineken didn't provide specific guidance for 2020, having

withdrawn all guidance in April, but said product and channel mix

is anticipated to continue to hurt its results, especially in

Europe, and that input costs will be higher than last year.

Mitigation actions will continue for the remainder of 2020, as

the company reduces all discretionary expenses in an attempt to

offset the hit from the pandemic. However, Heineken said the

benefits of these actions will be lower in the fourth quarter as

second-half costs were skewed toward the third quarter.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

October 28, 2020 05:51 ET (09:51 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

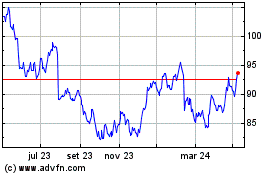

Heineken (EU:HEIA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

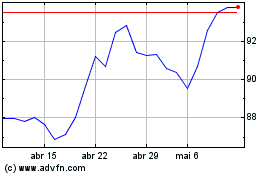

Heineken (EU:HEIA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024