Tiffany, LVMH Near Agreement on New Deal Terms -- 3rd Update

28 Outubro 2020 - 7:06PM

Dow Jones News

By Cara Lombardo and Dana Cimilluca

Tiffany & Co. is nearing an agreement to accept a lower

price in its takeover by LVMH Moët Hennessy Louis Vuitton SE,

ending a dispute between the luxury-goods companies that erupted

after the coronavirus pandemic upended the industry.

The companies have come to an agreement on new deal terms

calling for LVMH to pay $131.50 a share for the iconic U.S. jewelry

maker, according to people familiar with the matter. That's down

from an original price of $135 a share, equating to savings of

roughly $430 million for LVMH. It would allow the two sides to

avoid what would have been a costly and time-consuming trial set to

start in January.

Tiffany's board planned to consider the revised terms at a

meeting late Wednesday and there is no guarantee it will accept

them, the people said. Should it sign off, litigation over the deal

would be resolved, paving the way for a new shareholder vote and a

closing of the transaction possibly by January.

Tiffany agreed to sell itself to the European consumer

conglomerate late last year in a roughly $16.2 billion deal. LVMH,

whose roughly 75 brands include Louis Vuitton and Bulgari, saw an

opportunity to revamp the jeweler, which had struggled with weak

demand. It would also strengthen LVMH in China, where demand for

luxury goods has been steadily increasing as incomes rise, and

expand its presence in the U.S.

LVMH, with a market value of roughly $200 billion, is one of

Europe's most valuable companies and many times the size of

Tiffany. It has a long history of deal making, including a $13

billion move in 2017 to bring all of French fashion house Dior

under the ownership of LVMH.

But the Tiffany acquisition represented the biggest bet yet by

LVMH under Bernard Arnault, the French billionaire who has been its

chief executive and controlling shareholder for three decades. The

deal's merits changed when the pandemic spread around the world in

early 2020, forcing Tiffany and other retailers to close stores and

severely denting sales.

LVMH said in September it was backing out of the deal, using the

novel justification of trade disputes between France and the Trump

administration. It said it had received a letter from the French

foreign ministry asking it to delay the acquisition. Many saw the

move as a bid to lower the price. Tiffany Chairman Roger Farah said

at the time that there was no basis under French law to order a

company to breach a valid and binding agreement and a French

diplomatic official also said such a letter wouldn't be

binding.

Tiffany sued LVMH in Delaware Chancery Court to enforce the

agreement or obtain damages. That prompted LVMH to countersue,

arguing the U.S. jeweler's business had been so deeply damaged

during the pandemic that their takeover agreement was no longer

valid. Some legal experts have said LVMH faced long odds of

prevailing.

Whether in the end it turns out to have been a good move for

LVMH to challenge the deal -- for a $400 million-plus discount --

remains to be seen, especially given the likelihood that future

counterparties will take note.

Tiffany shareholders have continued to receive a 58-cent

per-share quarterly dividend meanwhile and may get another one

before the deal closes. LVMH had criticized the company's decision

not to cut its dividend despite losing money during the coronavirus

crisis.

The tie-up is the highest-profile deal to sour as a result of

the pandemic, though far from the only one, especially among

companies in the hard-hit retail sector. Private-equity firm

Sycamore Partners sued Victoria's Secret parent L Brands Inc. in

April, arguing that the retailer had violated the terms of their

merger agreement by closing stores, furloughing workers and

skipping rent payments. L Brands countersued and the two sides

eventually agreed to scrap the deal.

Mall landlord Simon Property Group Inc. sued to terminate a $3.6

billion deal to buy high-end mall developer Taubman Centers Inc.

Taubman countersued and Simon later amended its complaint to argue

that Taubman since breached the merger agreement by renegotiating

its credit facilities. The companies are set to go to trial in

Oakland County Superior Court in Michigan next month.

Write to Cara Lombardo at cara.lombardo@wsj.com and Dana

Cimilluca at dana.cimilluca@wsj.com

(END) Dow Jones Newswires

October 28, 2020 17:51 ET (21:51 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

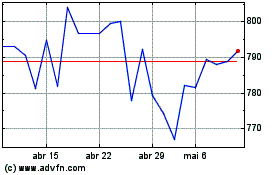

Lvmh Moet Hennessy Louis... (EU:MC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

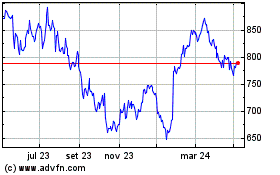

Lvmh Moet Hennessy Louis... (EU:MC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024