Chinese Liquor Giant Moutai Hits Heady $500 Billion Valuation

10 Fevereiro 2021 - 11:04AM

Dow Jones News

By Chong Koh Ping and Joanne Chiu

Kweichow Moutai Co., the best-known distiller of the fiery

Chinese spirit baijiu, has risen to a market value of more than

half a trillion dollars, making it the most visible symbol of

investor euphoria in China.

Moutai shares closed at a record high Wednesday, on the last

trading day before a weeklong Lunar New Year holiday. They have

more than doubled in the past 12 months, gaining more than 30%

since the start of 2021.

The rally has turned the liquor company into one of the world's

most valuable consumer-goods companies, outstripping giants such as

Procter & Gamble Co., Nestlé SA and LVMH Moët Hennessy Louis

Vuitton SE.

It is now roughly as important to the Chinese market as Apple

Inc. is in the U.S., accounting for 7.3% of the Shanghai Composite

Index while Apple makes up about 6.7% of the S&P 500. China's

biggest technology companies, Tencent Holdings Ltd. and Alibaba

Group Holding Ltd., aren't listed on the mainland.

Shanghai-listed Moutai makes an unlikely bedfellow for these

Western blue chips. The company is majority owned by the local

government in the southwestern Chinese province of Guizhou and its

chairman, Gao Weidong, was the regional government's top transport

official before assuming his post last year. The best-compensated

executive listed in its 2019 annual report received the equivalent

of about $130,500.

Compared with sluggish state-owned enterprises in areas such as

banking or oil, Moutai boasts more attractive growth prospects.

Analysts polled by FactSet expect net income to grow by 11.5% in

2020 and around 19% annually for the next two years.

It is also highly profitable: analysts forecast it will earn

$8.5 billion in net income for 2021, on revenue of $17.6 billion,

FactSet polling shows. In contrast LVMH, for example, is expected

to earn $9.3 billion from revenues of $67.8 billion for the same

calendar year.

Investors are willing to pay handsomely for that growth. Moutai

stock closed at 2,601 yuan, the equivalent of $403.34, on

Wednesday. It trades on 55 times expected earnings for the next 12

months, FactSet data shows, compared with an average of 26 times

over the last five years.

Foreigners have substantial holdings of Moutai, which only

reports financial results in Chinese. They hold about 8% of the

stock -- worth $40 billion at current prices -- through the Stock

Connect program, data from the Hong Kong stock exchange shows. U.S.

manager Capital Group is among Moutai's backers.

Enthusiasts point to the scarcity value of Moutai's namesake

baijiu, since production is limited, and the growing disposable

incomes of China's middle class. Premium baijiu is a status symbol

and is bought for gifts, weddings, parties and investment.

"Chinese consumers are drinking less overall but drinking better

products. Moutai is the key beneficiary of this premiumization

process," said Wei Wei Chua, a portfolio manager at Mirae Asset

Global Investments in Hong Kong. Mr. Chua said he had started

investing in Moutai shares a couple of years ago, and believed

price increases this year could support its earnings growth.

Individual investors dominate trading in Shanghai and Shenzhen,

which in the past has made China's onshore markets prone to

boom-and-bust cycles. A wave of money has washed into the markets

in recent months as many of these retail investors have backed new

mutual funds.

William Lo, a director at SilkyWater Asset Management in Hong

Kong, said valuations for many Chinese stocks were frothy. But he

said investors looking for fast-growing companies with strong

brands in China had no choice but to invest in companies such as

Moutai.

New investors were buying into Moutai based on premiumization, a

story that hasn't changed much in three years, said Allen Cheng, an

equity analyst at Morningstar in Singapore.

Mr. Cheng reckons the company will lift production capacity

about 10% annually for the next three years. He said that could end

the supply shortages that have helped lift prices for Moutai's

drinks and its shares.

When it comes to the stock price, Mr. Cheng cautioned: "This is

not a pure fundamental story that we're talking about. But it's

also hard to judge where the peak is."

Write to Chong Koh Ping at chong.kohping@wsj.com and Joanne Chiu

at joanne.chiu@wsj.com

(END) Dow Jones Newswires

February 10, 2021 08:49 ET (13:49 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

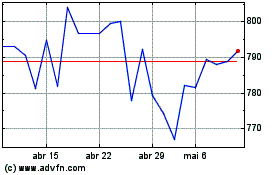

Lvmh Moet Hennessy Louis... (EU:MC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

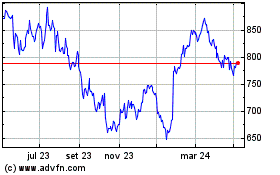

Lvmh Moet Hennessy Louis... (EU:MC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024