Kering Falls on Poor Sales for Gucci in 2020

17 Fevereiro 2021 - 6:13AM

Dow Jones News

By Joshua Kirby

Kering shares dropped sharply Wednesday after sales at key brand

Gucci clouded the company's 2020 earnings report.

At 0835 GMT, shares traded down 8.5% at 517.20 euros

($626.10).

Gucci, by far the French luxury-goods conglomerate's biggest

brand, posted a 10% sales decline in the final quarter of 2020 to

take it to a 23% drop for the full year, lagging behind stable

mates such as Balenciaga and Bottega Veneta that increased their

sales over the year.

The figures represent a gap of some 30 percentage points in the

quarter against rival soft-luxury brands at LVMH Moet Hennessy

Louis Vuitton, Bernstein analyst Luca Solca noted. "We expect

market pressure to increase on Gucci to produce efforts aimed at

reinstating momentum," he said.

Questions will center around Kering's strategy to boost its

powerhouse brand, according to RBC Capital Markets analyst Piral

Dadhania. "We believe today's print will raise further questions on

the revenue-recovery profile for Gucci, and the investment

requirements," Mr. Dadhania said.

Write to Joshua Kirby at joshua.kirby@dowjones.com;

@joshualeokirby

(END) Dow Jones Newswires

February 17, 2021 03:58 ET (08:58 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

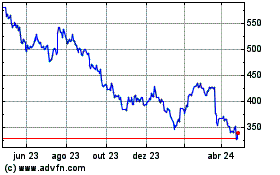

Kering (EU:KER)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

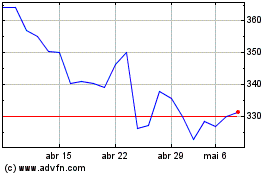

Kering (EU:KER)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024