IBM Explores Sale of IBM Watson Health

18 Fevereiro 2021 - 10:36PM

Dow Jones News

By Laura Cooper and Cara Lombardo

International Business Machines Corp. is exploring a potential

sale of its IBM Watson Health business, according to people

familiar with the matter, as the technology giant's new chief

executive moves to streamline the company and become more

competitive in cloud computing.

IBM is studying alternatives for the unit that could include a

sale to a private-equity firm or industry player or a merger with a

blank-check company, the people said. The unit, which employs

artificial intelligence to help hospitals, insurers and drugmakers

manage their data, has roughly $1 billion in annual revenue and

isn't currently profitable, the people said.

Its brands include Merge Healthcare, which analyzes mammograms

and MRIs; Phytel, which assists with patient communications; and

Truven Health Analytics, which analyzes complex healthcare

data.

It isn't clear how much the business might fetch in a sale, and

there may not be one.

Write to Laura Cooper at laura.cooper@wsj.com and Cara Lombardo

at cara.lombardo@wsj.com

(END) Dow Jones Newswires

February 18, 2021 20:21 ET (01:21 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

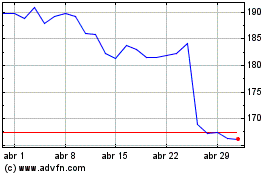

International Business M... (NYSE:IBM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

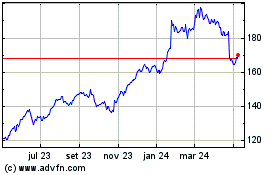

International Business M... (NYSE:IBM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024