Walmart, Goldman Sachs, Amazon.com: Stocks That Defined the Week

19 Fevereiro 2021 - 9:55PM

Dow Jones News

By Francesca Fontana

Walmart Inc.

Walmart hopes to put a smiley face on more than 400,000 of its

workers. On Thursday, America's largest private employer promised

to raise hourly wages to an average above $15 for its U.S. workers

in digital and stocking roles. Its minimum starting wage for those

workers remains $11 an hour, while rivals Amazon.com Inc., Target

Corp. and Best Buy Co. pay U.S. workers a starting hourly wage of

$15. Walmart shares lost 6.5% Thursday.

Goldman Sachs Group Inc.

Goldman Sachs is bringing its investing expertise to the masses.

The elite Wall Street firm is set to unveil Marcus Invest, a

low-cost digital platform that allocates and automatically

rebalances individuals' wealth across portfolios of stocks and

bonds based on the models developed by its investment-strategy

committee. Goldman has historically targeted wealthy clients with

more than $10 million in assets for its wealth-management services,

while the account minimum for Marcus Invest customers is just

$1,000. The new platform will be tucked into Goldman's existing

Marcus consumer-banking app and website, which also offers savings

accounts, unsecured personal loans and budgeting software. Goldman

Sachs shares gained 1.8% Tuesday.

Marriott International Inc.

The man who built Marriott into a global colossus died Monday.

Arne Sorenson was the first person outside the founding family to

head the hotel company. A Lutheran missionary's son who was born in

Japan and grew up in Minnesota, Mr. Sorenson became CEO of Marriott

in 2012 and continued to serve in the role after he was diagnosed

with stage 2 pancreatic cancer in May 2019. Marriott prevailed over

rival bidders in 2016 with its $13 billion acquisition of Starwood

Hotels & Resorts Worldwide Inc., creating a giant with 30

brands including Ritz-Carlton and Sheraton. Marriott shares added

0.7% Tuesday.

Verizon Communications Inc.

Warren Buffett is making a big new bet on the telecommunications

industry. The billionaire's conglomerate purchased $8.6 billion in

stock in Verizon Communications Inc., the largest U.S. mobile

carrier. Berkshire Hathaway also purchased $4.1 billion in the oil

company Chevron Corp. The investments show Berkshire's confidence

in the long-term value of these traditional U.S. corporations and

their respective industries, despite short-term struggles. In 2020,

Chevron had its worst year since 2016, and Verizon's fourth-quarter

profit fell after it reported higher costs and added fewer new

customers than usual. Verizon shares gained 5.2% Wednesday.

Amazon.com Inc.

New York state is taking Amazon to court. State Attorney General

Letitia James filed a lawsuit against the online retail giant on

Tuesday, accusing the company of not doing enough to protect its

New York workers from the coronavirus. Ms. James's suit claims that

Amazon failed to comply with state cleaning and disinfection

requirements at its facilities, nor did it adequately notify

employees of infected co-workers. Last week, Amazon sued Ms. James

in an attempt to stop New York from taking legal action against the

company over its handling of worker safety during the pandemic and

the firing of one of its warehouse workers last year. Amazon.com

shares rose 1.2% Wednesday.

NXP Semiconductors NV

Chip makers are powering down their Texas factories due to the

winter storm. The state has asked semiconductor companies such as

NXP Semiconductors and Samsung Electronics Co. to shut down

operations in Austin to help conserve energy during the

catastrophic weather hitting parts of the South. The conditions

left millions of Texans without power for days, and the outages

prompted local officials to ask companies to reduce operations to

minimize demand on the region's power grid. The factory disruptions

come at a critical time for the chip industry, which already faces

a shortage due to surging demand during the pandemic. NXP shares

fell 2% Thursday.

GameStop Corp.

Lawmakers want answers on what drove the wild rally in

GameStop's shares last month. On Thursday, top executives of

Robinhood Markets Inc., Reddit Inc. and others faced questions from

the House Financial Services Committee about their roles in the

saga. The short squeeze, during which a group of online traders

helped send shares of the videogame retailer surging before the

stock crashed, led to questions about the market's integrity and

set off federal probes into possible market manipulation. Robinhood

Chief Executive Vlad Tenev used his oral testimony to apologize to

customers for suspending GameStop trading during the frenzy, and

Reddit CEO Steve Huffman said that activity on his company's

social-media platform during last month's trading craze was "well

within normal parameters." GameStop shares fell 11% Thursday.

Write to Francesca Fontana at francesca.fontana@wsj.com

(END) Dow Jones Newswires

February 19, 2021 19:40 ET (00:40 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

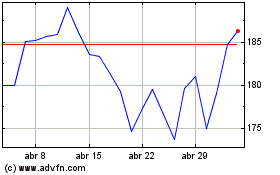

Amazon.com (NASDAQ:AMZN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Amazon.com (NASDAQ:AMZN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024