Yogurt Giant Danone Posts an Unappetizing Job Ad

02 Março 2021 - 10:22AM

Dow Jones News

By Carol Ryan

Investors have soured on the maker of Dannon yogurt. A proposed

management change isn't enough of a sweetener.

After a board meeting on Monday, Paris-based Danone said that

Chief Executive Officer Emmanuel Faber will step aside. The boss

has been trying to save his job since Wisconsin-based investor

Artisan Partners last month declared a 3% stake and said it wanted

him out. Danone also has activist hedge fund Bluebell Capital

Partners among its unhappy shareholders.

The new CEO may not have a free rein. Mr. Faber will stay on as

chairman and wants to push ahead with a restructuring -- his second

major attempt at an overhaul in seven years -- that is unpopular

with certain investors. The company's shares fell 1% in early

European trading Tuesday, perhaps a sign that shareholders don't

believe much can change under this setup.

The person who takes on the role needs to fix years of poor

performance. During Mr. Faber's tenure, which began in late 2014,

Danone has delivered total annual shareholder returns of 3% in

dollar terms. That is less than half what European food peers

Unilever and Nestlé managed over the same period and below what

Campbell Soup delivered with a far less wholesome portfolio of

brands.

Danone's lucrative baby-food business is under pressure in

China, where competition from local brands is heating up and

birthrates plummeted 15% in 2020. Artisan Partners have also argued

that Danone should sell off its cheaper water brands -- a step

Nestlé has taken -- and traditional dairy business. Both categories

are becoming commoditized as private-label rivals muscle in.

In Danone's defense, when Nestlé's current CEO Mark Schneider

took over in 2017, investors wondered whether he could really shake

up the business while his predecessor stayed on as chair. Yet he

has since successfully revamped the Swiss food giant.

Danone may not get the benefit of the doubt. The current

management team has lost investors' trust. Despite overpaying for

U.S. dairy-alternative player WhiteWave in 2016, the company has

been losing share to upstarts like oat-milk maker Oatly in the

booming plant-based food and drink market. This may be part of a

pattern: Dannon was also slow to react to the threat posed by Greek

yogurt brand Chobani in the U.S. several years ago.

Danone may feel that it has come up with a fair compromise, but

it will likely leave investors hungry for more.

Write to Carol Ryan at carol.ryan@wsj.com

(END) Dow Jones Newswires

March 02, 2021 08:07 ET (13:07 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

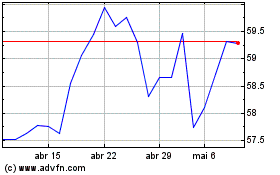

Danone (EU:BN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

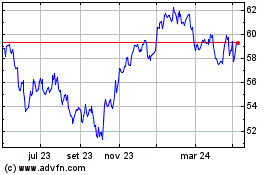

Danone (EU:BN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024