Vodafone Raises EUR2.3 Billion in Vantage Towers IPO

18 Março 2021 - 4:50AM

Dow Jones News

By Joe Hoppe

Vodafone Group PLC said Thursday that it and its European towers

unit Vantage Towers AG have set a final offer price of 24 euros

($28.76) a share for Vantage Towers' initial public offering.

The U.K. telecommunications company said that Vantage Towers has

placed 95.8 million shares, resulting in gross proceeds of EUR2.3

billion. The successful offering implies a market capitalization of

EUR12.1 billion for Vantage Towers.

The shares placed represent 18.9% of Vantage Towers' issued and

outstanding share capital, and Vodafone will use the net proceeds

from the placing to pay down debt.

Trading of the shares on the Frankfurt Stock Exchange is

expected to begin Thursday under the ticker VTWR.

"This IPO unlocks value for our shareholders: it demonstrates

the value of our towers assets in a 5G world, sets up Vantage

Towers to unlock its full potential as a focused independent tower

operator, with the proceeds reducing group debt," Vodafone Group

Chief Executive Nick Read said.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

March 18, 2021 03:35 ET (07:35 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

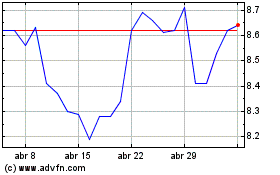

Vodafone (NASDAQ:VOD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Vodafone (NASDAQ:VOD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024