By Chong Koh Ping

Investors are betting that China's two biggest sportswear

companies will emerge from the pandemic even stronger.

The Hong Kong-traded shares of both Anta Sports Products Ltd.

and Li Ning Co. have more than doubled in the past 12 months,

pushing measures of valuation such as price-earnings ratios

unusually high. Anta's stock closed at 130.90 Hong Kong dollars

Wednesday, the equivalent of $16.83, giving it a market value of

more than $45 billion.

HSBC analyst Lina Yan said the two are the only domestic brands

expanding their shares of the Chinese market. "This scarcity value

attracted investors from all avenues," she said.

Anta ranks third and Li Ning fourth in China, according to

market-research firm Euromonitor International, trailing only Nike

Inc. and Adidas AG. And the Chinese companies' stock-price gains

beat both: Nike has risen 62% in the 12 months to Tuesday, giving

it a market value of about $217 billion, while Adidas is up

37%.

In the past two weeks, local apparel stocks including Anta and

Li Ninga have also gotten a boost from a Chinese boycott of

international businesses that have shunned cotton produced in the

western Xinjiang region over forced-labor concerns.

That suggests investors expect the boycott to lift domestic

brands' sales at the expense of Nike and Adidas, which have been

embroiled in the controversy. Analysts see that confidence as

premature.

"It's too early to tell if the saga could boost sales," said

Tony Li, an analyst at Haitong International. "The share-price jump

was sentiment-driven; it wasn't rooted in fundamentals."

More broadly, though, younger Chinese consumers increasingly

favor domestic brands as they catch up with foreign brands in

quality and innovation--a long-term trend that should work in favor

of Anta and Li Ning.

The two Chinese giants have taken different approaches. Anta

sells brands such as Fila and Descente in China, as well as clothes

and shoes bearing its own name. Li Ning, founded by the Olympic

gymnast of the same name, focuses on a single brand.

Both companies have international sponsorship deals: In

basketball, Anta works with Golden State Warriors guard Klay

Thompson, for example, while Li Ning has signed players such as

Toronto Raptors guard Fred VanVleet and Miami Heat forward Jimmy

Butler.

They have stronger management than their smaller domestic

rivals, said analyst Mr. Li, and were better able to switch to

selling online during the pandemic, helping widen the gap between

them and those Chinese competitors. For 2020, Anta reported a 53%

increase in online revenue; Li Ning, 23%.

When bricks-and-mortar stores shut during lockdowns early last

year, the companies started selling more products via social-media

platforms and live-streaming apps.

"The market leaders have the resources to use new marketing

campaigns to draw younger customers," said Mr. Li. For example,

Anta has hired Li Jiaqi, an online opinion leader known as China's

"lipstick king," to promote its products.

Morningstar equity analyst Ivan Su said two other structural

shifts favor the Chinese giants. One is the home market's

potential. "There is room for bigger growth off a lower base," he

said. The average Chinese consumer spends $20 to $30 a year on

sneakers, sweatpants and other outdoor and sports-inspired

clothing, he estimated, about a 10th of what a U.S. consumer

spends.

The other is that people are growing more comfortable donning

active wear even when they aren't exercising. It's a global trend,

but "especially in China, sportswear is a big part of daily wear,"

he said.

Euromonitor says sector-wide sales in China will grow 21% this

year. They shrank 1.5% last year, after growing between 16% and 21%

annually from 2016 to 2019.

One cause for concern: The stocks' valuations have risen far

beyond their five-year averages. Anta's stock trades at 36 times

forecast earnings, similar to the ratios of Nike and Adidas, and Li

Ning is even pricier, at 43.5 times, according to FactSet.

The financial system is flush with money chasing riskier

investments, including funds that have flowed from mainland China

into Hong Kong stocks, said Mr. Su. That extra liquidity has helped

push the stocks higher, he said.

He values Anta at close to the current share price. "The share

price has more than doubled in one year, but the fundamentals

haven't doubled," said Mr. Su.

HSBC's Ms. Yan said any share-price gains for the two companies

this year would be driven by profit growth rather than further

rises in their price-earnings ratios, given that their valuations

are now close to those of their international peers.

Write to Chong Koh Ping at chong.kohping@wsj.com

(END) Dow Jones Newswires

April 07, 2021 05:44 ET (09:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

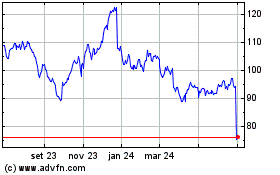

Nike (NYSE:NKE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

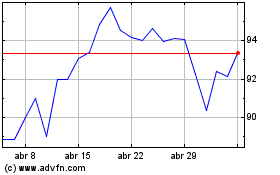

Nike (NYSE:NKE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024