By Michael Wursthorn and Peter Rudegeair

The collapse of Bill Hwang's Archegos Capital Management in late

March took many investors and several banks by surprise when

ViacomCBS Inc. and Discovery Inc.'s share prices tumbled. It turns

out that some companies were also left wondering why their share

prices whipsawed.

Executives at online lender LendingClub Corp. and digital

streaming service fuboTV Inc. still aren't sure if sudden swings in

their stock were from banks unloading billions in Archegos

investments--or if the drop was from something else entirely,

according to people familiar with the matter.

Archegos had previously told executives at LendingClub that it

was a big shareholder, said one of the people. But without the

regular disclosures that investment firms typically make after they

build up a sizable stake in a stock, those executives didn't have a

way to verify the ownership claim.

It might seem surprising that a company can't pinpoint why its

stock suddenly falls, but the Archegos meltdown shows how difficult

it can be for executives to determine who owns their company's

stock and for what reason.

A chorus of companies and advocacy groups are now calling on

regulators to revise financial-disclosure guidelines, particularly

around loosely regulated family offices such as Archegos and around

the use of derivatives, investor bets linked to stock prices

instead of the stocks themselves.

"The U.S. has gone from a leader in timely disclosure to a

laggard internationally," said Leo Strine Jr., a former chief

justice of the Delaware Supreme Court who is now a corporate

attorney at Wachtell, Lipton, Rosen & Katz.

"Even more embarrassingly, the U.S. fails to cover derivatives

and other relevant instruments that affect target companies," he

said. "We have a 1975-era regulatory regime governing a 21st

century economy, and it's high time it was fixed."

Family offices such as Mr. Hwang's are lightly regulated. A law

passed in the wake of the financial crisis intended to shore-up

financial markets, known as the Dodd-Frank Act, included an

exemption for family offices from certain reporting requirements

that pertain to most other investment firms managing more than $100

million.

Archegos was still subject to filing other stock-ownership

disclosures required by securities laws, but the firm appeared to

avoid those through its use of a type of derivative known as total

return swaps--investments made by banks on behalf of clients for a

fee. The swaps hid Mr. Hwang's holdings from the companies he

invested in, obscuring how much each was exposed to a single

investor. Archegos declined to comment.

Archegos is just one of more than 10,000 family offices that

collectively manage nearly $6 trillion in assets, said advocacy

group Americans for Financial Reform in a letter calling on the

Securities and Exchange Commission to take action to tighten

disclosure rules around such firms.

"There is no reason why large investors whose decisions can

significantly impact other investors and companies should be able

to avoid the same scrutiny other investors face simply because of

how they choose to structure their trade or their investment firm,"

the group said in the letter.

To be sure, individual stocks move because of broader factors in

the market and separate industries that wouldn't be clear even with

more aggressive disclosure requirements.

Public disclosures showed the various banks that Mr. Hwang had

worked with--including Credit Suisse Group AG, Nomura Holdings

Inc., Morgan Stanley and Goldman Sachs Group Inc.--as being the

major shareholders in stocks rather than Archegos. When a bank is

listed as a shareholder, companies have no way of knowing if the

investment is on behalf of a single investor, multiple investors or

the bank itself.

Archegos had built up a large stake in ViacomCBS, so when the

stock fell, Archegos and its banks sold off Archegos's holdings to

back up the trades. The banks unloaded more than $30 billion in

positions that Archegos had built up in ViacomCBS, Discovery and a

handful of other companies, sparking huge declines and setting in

motion the family office's meltdown.

Around the same time, shares of online lender LendingClub

slumped 11% on March 26, its biggest single-day pullback since May

of last year, and digital streaming service fuboTV's stock dropped

15% that same day.

If Archegos owned LendingClub or fuboTV stocks, the firm might

have driven down the share price by selling off its holdings.

Company executives were stumped by the sudden pullback of their

share prices until news broke of the Archegos meltdown, according

to people familiar with the matter.

Employees at fuboTV passed around a tweet from a pseudonymous

Twitter account after its shares fell on March 26, according to a

person familiar with the matter.

The tweet purported to show Archegos positions held at Nomura,

including 4.7 million shares of fuboTV. The employees

cross-referenced fuboTV's largest shareholders on FactSet and saw

that its largest one was Nomura, with 4.7 million shares as of the

end of 2020.

One other firm on the list, Viper Energy Partners LP, a spinoff

from West Texas oil producer Diamondback Energy Inc., said the

buildup of stakes by banks' prime brokerage arms was unusual and

now after the incident suggests that Archegos may have been

involved.

Nomura's prime-brokerage arm is one of Viper Energy's largest

shareholders, owning a nearly 5% stake. That large of a stake by a

prime broker is rare, said Kaes Van't Hof, president of Viper

Energy. The firm hasn't tried to confirm whether Archegos was

involved, Mr. Van't Hof said, adding that it is "hard to impossible

to find out from the prime brokers who actually owns the stock"

even if they had reached out. Nomura declined to comment.

Shares of Viper Energy had mostly fallen around the time

Archegos's bets collapsed, with shares dropping nearly 10% over a

three-week stretch ended April 9.

"It's a bit one-sided how much public companies have to disclose

versus investment funds," Mr. Van't Hof added.

LendingClub and fuboTV shares have mostly fallen since late

March, with the latter's declines drawing it down 34% for the year.

Shares of Viper Energy, meanwhile, have rebounded somewhat, rising

about 15% so far this month.

One other stock Mr. Hwang might have been involved with is

Chinese educational app maker iHuman Inc.

Shares of the company had mostly struggled since it went public

in October. But on March 29, amid Archegos's fall, iHuman's stock

experienced its second-biggest decline ever, sliding 13%.

Like Mr. Hwang's other bets that are now publicly known, banks

such as Credit Suisse and Nomura populate iHuman's top holdings,

according to FactSet. The only other clue that the family office

might have been involved is that an Archegos junior analyst had

contacted iHuman for a meeting, a person with knowledge of the

matter said.

A spokesman for iHuman said the company supported the call for

regulators to revise disclosure guidelines for investment

firms.

"I think we are in agreement with many companies in the market

that there should be greater transparency around the disclosure of

fund holdings," the spokesman said in an email. "We hope the SEC

will take a look at this and help increase transparency in the

market."

Write to Michael Wursthorn at Michael.Wursthorn@wsj.com and

Peter Rudegeair at Peter.Rudegeair@wsj.com

(END) Dow Jones Newswires

April 21, 2021 05:44 ET (09:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

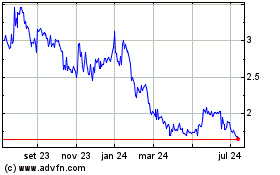

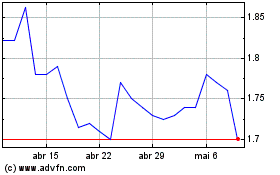

iHuman (NYSE:IH)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

iHuman (NYSE:IH)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024