By Sarah E. Needleman

"Fortnite" maker Epic Games Inc. deliberately violated Apple

Inc.'s app-marketplace rules to show the power that Apple wields

and that the tech giant takes an unfair share of money from

software developers, the videogame company's chief executive

testified in a trial Monday.

"Apple was making more profit from selling developer apps in the

App Store than developers," said Tim Sweeney, whose company's

global hit "Fortnite" was removed from Apple's mobile app platform

last August.

The statements from Mr. Sweeney, a 50-year-old programmer who

founded Epic in 1991, in an Oakland, Calif., courtroom came on the

first day of a planned three-week bench trial, one that could help

reshape the multibillion-dollar market for distributing apps on

mobile devices.

Mr. Sweeney, who donned a blue suit instead of his usual attire

of cargo pants and a T-shirt, had been plotting the moment for

months. His closely held company in August inserted its own,

unauthorized payment system into the versions of "Fortnite" on the

app stores that Apple and Alphabet Inc.'s Google control, as a way

to circumvent the 30% fee the companies collect from in-app

purchases.

Both companies yanked the combat game from their app stores in

response, as Epic expected, prompting it to file lawsuits against

them, as well as launch a public-relations campaign critical of

Apple to draw support from consumers and other app developers. A

trial date for Epic's suit against Google hasn't been set.

Mr. Sweeney spent about three hours on the stand, fielding

questions from a range of trial participants including Epic

attorney Katherine Forrest, Apple lawyer Richard Doren and U.S.

District Judge Yvonne Gonzalez Rogers, who will decide the

case.

The trial started about 15 minutes late because of technical

issues that ended up persisting throughout the day, making it

difficult for the hundreds of journalists and others listening in

to hear the speakers clearly. Early in the day Judge Gonzalez

Rogers complimented the lawyers on their professionalism and work

to ensure things go smoothly.

In his testimony, Mr. Sweeney said his company, now valued at

nearly $29 billion, had been happily contributing to Apple's app

ecosystem since 2010 but the relationship changed over the years as

the iPhone maker's policies grew more restrictive -- a claim Apple

denied. Attorneys for Apple defended its policies as critical for

its App Store's viability and success.

Epic worked to cast Apple as a monopolist in how it operates the

App Store, which was created in 2008. Users of Apple's iPhone and

iPads can only download software from its App Store and the company

requires purchases of digital goods and services in apps to be

processed through its payment system. Ms. Forrest told the court

that Epic isn't seeking monetary damages, but rather aims to unlock

Apple's so-called walled garden for itself and all app

developers.

"The garden could've had a door. It's artificially walled in,"

said Ms. Forrest, an attorney with Cravath, Swaine & Moore LLP

who is a former New York federal judge. In building its mobile

operating system known as IOS, "Apple's plan was to lock users in

and prevent users from switching away from the Apple ecosystem,"

she said.

Karen Dunn, an attorney for Apple, defended the iPhone maker's

App Store policies and the 30% fee the company charges developers

on digital sales.

"Apple did not create a secure and integrated ecosystem to keep

people out," said Ms. Dunn, a partner at Paul Weiss Rifkind Wharton

& Garrison LLP who represented Apple in its lawsuit against

Qualcomm Inc. over patent-licensing fees. Instead, Apple did so to

"invite developers in without sacrificing the privacy and

liability, security and quality that consumers wanted," she

said.

Ms. Dunn also challenged Epic's definition of a competitive

market, saying its perspective is too narrow because there are many

platforms where consumers and developers engage in transactions,

including personal computers and three major game consoles. She

argued consumers move fluidly between platforms and can purchase

game currency for "Fortnite" on one platform and spend it on

another.

Apple's attorneys further argued that Epic was motivated to

break Apple's rules because "Fortnite" was waning in popularity.

Epic has denied that accusation. A document was filed Monday with

the court showing "Fortnite" revenue declined significantly in 2019

from 2018. Epic has generated about $13.1 billion of revenue from

"Fortnite" between the game's introduction in 2017 and the end of

last year, said Mr. Sweeney, confirming data shared by Mr.

Doren.

The Epic CEO is expected to return to the witness stand Tuesday

as cross-examination continues.

In addition to Mr. Sweeney, Epic's witness list includes other

company executives, former Apple employees and employees of

companies including Microsoft Corp.

Apple's witness list includes the company's CEO for nearly a

decade, Tim Cook, and other executives such as Phil Schiller, who

played a key role in the launches of the iPod, iPhone and iPad and

currently holds the title of Apple Fellow.

Antitrust cases can be difficult for plaintiffs to win, legal

experts say, and Epic's lawsuit may hinge on the court's definition

of a market in the digital age. Epic says Apple has a monopoly in

its App Store, while Apple says it is just one of many distribution

channels in the larger market for videogames and other

software.

Analysts say an appeal is likely whatever the trial's outcome, a

possibility the judge outlined last year in hearings.

Apple faces scrutiny from regulators elsewhere over its business

practices. The European Union on Friday charged the company with

violating antitrust laws for allegedly abusing its control over the

distribution of music-streaming apps. The U.K. is separately

investigating whether Apple imposes anticompetitive conditions on

app developers, and U.S. lawmakers have accused Apple of operating

with "monopoly power."

In response to the EU charges, Apple said Spotify has been

successful even after removing paid subscriptions from its app in

the App Store. Apple also said Spotify's demand to be able to

advertise alternative deals through its App Store is a practice

that no stores allow.

Write to Sarah E. Needleman at sarah.needleman@wsj.com

(END) Dow Jones Newswires

May 03, 2021 20:44 ET (00:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

Alphabet (NASDAQ:GOOG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

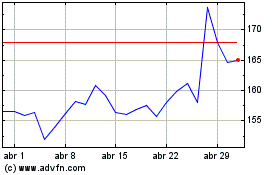

Alphabet (NASDAQ:GOOG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024