ICBC, Goldman Sachs Wealth Management JV Gets Regulatory Nod

25 Maio 2021 - 7:16AM

Dow Jones News

By Clarence Leong

Chinese regulators have approved a wealth management joint

venture between Industrial & Commercial Bank of China Ltd. and

Goldman Sachs Group Inc., as the country further opens up its

lucrative financial markets to foreign banks.

An ICBC unit will contribute 49% of the venture's funding, while

Goldman Sachs Asset Management will contribute the rest, according

to a filing by ICBC to the Hong Kong stock exchange on Tuesday.

ICBC said the venture will help it provide more diversified and

professional wealth management services, and improves the bank's

ability to serve the real economy.

Goldman Sachs has sought to deepen its investment in the world's

second-largest economy. Last December, it applied to take full

control of Goldman Sachs Gao Hua Securities Co. by acquiring the

49% share of the venture it didn't own. Goldman Sachs was the first

global bank to seek full ownership of its securities business in

China.

Other global financial firms have been moving to expand wealth

management offerings in China's fast-growing financial market.

Earlier this month, BlackRock Inc., the world's largest money

manager, received the go-ahead from Chinese regulators to start a

wealth management business in the country. In March, a unit of

JPMorgan Chase & Co. agreed to buy a 10% stake in China

Merchants Bank's wealth management unit for around $410

million.

Write to Clarence Leong at clarence.leong@wsj.com

(END) Dow Jones Newswires

May 25, 2021 06:01 ET (10:01 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

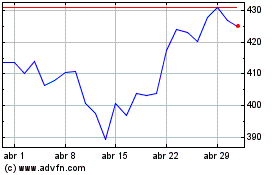

Goldman Sachs (NYSE:GS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

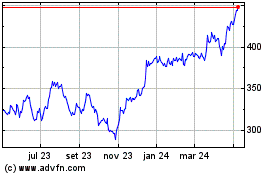

Goldman Sachs (NYSE:GS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024