Goldman Targets China Wealth Management With ICBC Tie-Up --Update

25 Maio 2021 - 9:36AM

Dow Jones News

By Clarence Leong and Jing Yang

Chinese regulators have approved a wealth-management joint

venture between Goldman Sachs Group Inc. and Industrial &

Commercial Bank of China Ltd., as China further opens up its

lucrative financial sector to foreign banks.

Goldman's asset-management arm will own 51% of the venture, and

the remainder will be held by an ICBC wealth-management subsidiary,

the New York-based bank said Tuesday.

ICBC, one of China's largest state-owned banks, said the venture

will help it provide more diversified and professional

wealth-management services and would improve the bank's ability to

serve the real economy.

In China, wealth-management businesses run by banks typically

sell investment products to a range of individuals. Goldman on

Tuesday cited its own research estimating that investible assets

held by Chinese households could surpass $70 trillion by 2030.

About 60% of that could be allocated to non-deposit products

including securities, mutual funds and wealth-management products,

the firm said.

Goldman said the new venture has received preliminary approval

from the China Banking and Insurance Regulatory Commission, and it

intends to develop a range of investment products for the China

market. That would include "quantitative investment strategies,

cross-border products and innovative solutions in alternatives,"

Goldman said.

Goldman has sought to expand its presence in the world's

second-largest economy. Last December, it applied to take full

control of Goldman Sachs Gao Hua Securities Co. by acquiring the

49% share of the venture it didn't own. Goldman Sachs was the first

global bank to seek full ownership of its securities business in

China.

Other global financial firms have also been moving to expand

wealth management offerings in China, which for years placed

ownership restrictions on foreign financial institutions. A January

2020 trade pact between Washington and Beijing promised greater

access to China's financial sector for American institutions.

In March this year, JPMorgan Chase & Co. agreed to pay $410

million for a minority stake in a leading wealth-management

business owned by China Merchants Bank. That deal marked the first

time a Chinese bank has opened up its wealth-management subsidiary

to a foreign strategic investor. J.P. Morgan Asset Management is

separately awaiting approval to take full ownership of its fund

management joint venture in China.

Earlier this month, BlackRock Inc., the world's largest money

manager, received a green light from China's banking regulator to

commence a wealth management joint venture with a unit of

state-owned China Construction Bank and Singapore's investment

company Temasek. BlackRock is separately preparing to start selling

mutual funds to individual investors in China via a wholly owned

business in the country.

Write to Jing Yang at Jing.Yang@wsj.com

(END) Dow Jones Newswires

May 25, 2021 08:25 ET (12:25 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

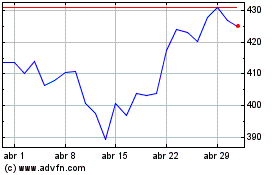

Goldman Sachs (NYSE:GS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

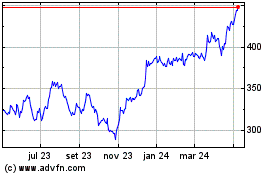

Goldman Sachs (NYSE:GS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024