HSBC To Exit U.S. Retail Banking

26 Maio 2021 - 10:16PM

Dow Jones News

By Kimberly Chin

HSBC Holdings PLC will exit from its U.S. retail and

small-business banking operations as the bank shifts its focus to

wealth management and international banking, especially in

Asia.

The banking giant said late Thursday that it will exit 90 of its

148 branches in the U.S. through a series of transactions. HSBC has

entered into agreements to sell parts of its business to Citizens

Financial Group Inc.'s Citizens Bank and Cathay General Bancorp's

Cathay Bank. It also plans to wind down around 35 to 40

branches.

HSBC will retain around two dozen locations in some of its

existing markets and convert the sites into so-called international

wealth centers, it said. That would help the bank focus on the

"banking and wealth management needs of globally-connected affluent

and high net worth clients," it added.

As such, the bank will no longer service banking customers with

balances below $75,000. It will also cut ties with all of its

retail business customers, which includes small businesses, it

said.

"This next chapter of HSBC's presence in the U.S. will see the

team focus on our competitive strengths, connecting our global

wholesale and wealth management clients to other markets around the

world," HSBC's Group Chief Executive Noel Quinn said in prepared

remarks. He said the bank's U.S. mass retail operations "are good

businesses, but we lacked the scale to compete."

The London-based lender, which makes most of its profit in Hong

Kong and mainland China, is more than a year into a major overhaul

to refocus its operations in Asia. In February, the bank said that

it was considering selling its unprofitable U.S. retail operations

and pouring about $6 billion of investment into Asia in the next

five years.

HSBC is also in talks to sell its unprofitable French retail

bank.

The bank said it has agreed to sell its East Coast mass market

and retail banking businesses, which include 80 branches and around

800,000 customer accounts, as well as its online bank portfolio to

Citizen Bank. Those accounts had about $9.2 billion in deposits and

$2.2 billion in outstanding loans as of the end of March.

HSBC's West Coast retail bank operations, which include 10

branches and about 50,000 customer accounts, would be sold to

Cathay Bank.

The deals, which are subject to regulatory approval, are

expected to close in the first quarter of 2022. HSBC said it

expects to incur about $100 million in pretax costs for the

transactions.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

May 26, 2021 21:14 ET (01:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

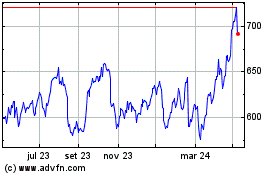

Hsbc (LSE:HSBA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

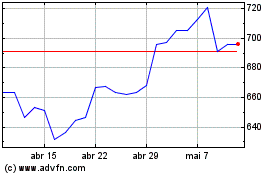

Hsbc (LSE:HSBA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024