By David Uberti and James Rundle

The Biden administration is examining cryptocurrency's role in

recent hacks that have disrupted important U.S. industries

including healthcare, fuel and food, exploring new ways to track

victims' payouts to foreign ransomware gangs.

White House officials this week said they are pushing to better

trace ransomware payments, which hackers demand to unlock

companies' data.

The move came after a cyberattack this weekend caused meat

processor JBS SA to pause production at U.S. and Australian plants.

That incident followed last month's hacks of Colonial Pipeline Co.

and Scripps Health in San Diego, showing how such extortion schemes

can snarl the U.S. economy and disrupt daily life.

The White House didn't respond to requests for details on its

approach to tracking the transactions or whether additional

regulation is in the works.

In a letter to business leaders Wednesday, Deputy National

Security Adviser Anne Neuberger said U.S. officials are working

with international partners on consistent policies for when to pay

ransoms and how to trace them.

Hackers ask for ransoms in cryptocurrency because it is

difficult to pursue across digital wallets and national borders.

U.S. officials discourage companies from paying ransoms, but many

do so when losing data would cripple their businesses. Paying

hackers who are affiliated with sanctioned entities, however, risks

penalties from the Treasury Department.

Some cybersecurity experts say the spate of attacks underscores

the need for a more aggressive approach to monitoring crypto

payments. In April, a task force of major tech companies and U.S.

officials called for governments to enforce know-your-customer

rules, similar to Treasury regulations, to improve transparency and

accountability of bitcoin and other digital money.

"There are some responsibilities that come with being a

responsible, mature currency in the world," said Michael Daniel, a

former Obama administration official who is now chief executive of

the Cyber Threat Alliance, a nonprofit intelligence-sharing

group.

But hackers and the exchanges that process their payouts often

operate overseas, limiting Washington's regulatory power. Improved

oversight of cryptocurrency exchanges abroad, which some cyber

experts say face lower regulatory standards, could require

international cooperation or pressure.

Ransomware specialists, however, are skeptical that restrictions

on bitcoin payments or tighter regulations will slow the growth in

ransomware. Restrictions on individual digital currencies such as

bitcoin mean criminals will just switch to another, less-regulated,

currency, and any regulation strong enough to deter payments to

criminals will take a long time to develop, said Lior Div, chief

executive of cybersecurity firm Cybereason Inc., which develops

software designed to combat ransomware.

Prominent U.S.-based cryptocurrency exchanges say they use

strong controls to prevent money laundering and identify clients.

Marco Santori, chief legal officer for Payward Inc.'s Kraken

cryptocurrency exchange, said Kraken's controls are equal to those

at major banks, and that large exchanges are in frequent

communication with regulators.

"There's this meme out there that crypto is unregulated and

crypto participants don't engage with the government. It just

couldn't be further from the truth," he said.

Businesses including Colonial -- which paid $4.4 million in

bitcoin to a gang known as DarkSide, believed to be in Eastern

Europe -- often make such payments to avoid costly outages of their

computer networks or the hard work of restoring systems from backup

data.

A representative for JBS didn't respond to requests for comment.

A spokeswoman for Scripps Health declined to comment.

Victims that pay ransoms typically engage third-party brokers

such as Chicago-based DigitalMint to convert their cash to

cryptocurrency. DigitalMint officials said they collect standard

know-your-customer data on clients and check hackers' digital

wallets for potential overlap with sanctioned entities in countries

such as Russia, where many ransomware groups operate.

Payments made by DigitalMint tend to go directly to overseas

markets. "A lot of what we see ends up at these big foreign

exchanges," said Seth Sattler, DigitalMint's director of

compliance.

Ransomware groups often spread cryptocurrency among many digital

wallets to disguise themselves and to hide potential connections

with sanctioned entities, Mr. Sattler said.

The Financial Crimes Enforcement Network, a part of the Treasury

Department known as FinCEN, has proposed additional rules in

December for many cryptocurrency transactions, requiring U.S.-based

banks and money-service businesses to vet some customers and report

transactions over $10,000.

Dmitri Alperovitch, chairman of the Silverado Policy

Accelerator, a think tank, said the FinCEN regulators should also

require companies to report the exchanges they use. That

information could help Treasury pinpoint which exchanges or

affiliated entities to target with sanctions, he said.

"Virtually every exchange around the world is dealing in some

form or fashion with U.S. currency," Mr. Alperovitch said. "The

U.S. could absolutely pressure all of them through sanctions and

the like to adopt the same policies."

A spokeswoman for the Treasury Department said it received over

7,000 comments on the proposed rule, and is working with the

concerned parties to ensure the final regulation balances costs and

benefits to the public and private sectors. The department is

monitoring emerging risks in this area daily, the spokeswoman

added.

Some ransomware victims and their cybersecurity consultants

voluntarily report to law enforcement data about ransom payments,

such as dates, wallet addresses and amounts, said Bill Siegel,

chief executive of Coveware Inc., a firm that helps clients respond

to incidents and negotiate with attackers.

"It's just a question of what they [law-enforcement officials]

do with it," he said. "There's nothing from a regulatory

perspective that I think would be effective in this, outside of

creating a broad mandatory reporting requirement for victims of

ransomware.

Write to David Uberti at david.uberti@wsj.com and James Rundle

at james.rundle@wsj.com

(END) Dow Jones Newswires

June 03, 2021 18:49 ET (22:49 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

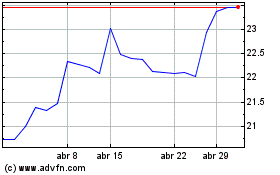

JBS ON (BOV:JBSS3)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

JBS ON (BOV:JBSS3)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024