TUI AG Expects EUR200 Million Funds Inflow From Tap Bond Offering

29 Junho 2021 - 2:17AM

Dow Jones News

By Joe Hoppe

TUI AG said it has successfully completed its tap offering of

convertible bonds and expects a funds inflow of around 200 million

euros ($238.5 million).

The German travel operator said its offering had a principal

amount of EUR190 million, issued at a price of 105.86% of their

original amount, resulting in an inflow of around EUR200

million.

The bonds are due in 2028 and are fully fungible with the EUR400

million bonds issued on April 16.

TUI intends to use the money for refinancing, and in particular

to further reduce drawings under the KfW facilities--which are

backed by the German state--and toward a subsequent repayment of

such facilities.

Citigroup Global Markets Europe AG, Credit Agricole Corporate

and Investment Bank, HSBC and UniCredit Bank AG are acting as joint

global coordinators and joint bookrunners for the offering.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

June 29, 2021 01:14 ET (05:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

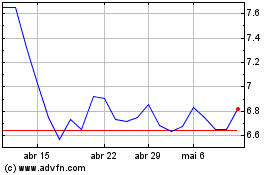

Tui (TG:TUI1)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

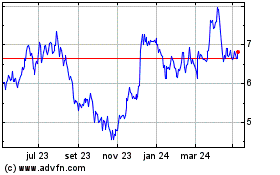

Tui (TG:TUI1)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024