Anglo American 1st Half Profit Reflects Stronger Production, Commodity Prices -- Commodity Comment

29 Julho 2021 - 4:42AM

Dow Jones News

By Jaime Llinares Taboada

Anglo American PLC on Thursday reported that its profit

increased in the first half driven by higher production and

commodity prices. Here's what the FTSE 100 mining company had to

say:

On production:

"Improved operational performances at PGMs, De Beers, Kumba

(Iron Ore) and Copper contributed to a 10% production increase on a

copper equivalent basis, driven in part by the easing of Covid-19

related restrictions that impacted production in the first half of

2020, as well as higher throughput at Mogalakwena (PGMs) and strong

plant performance at Los Bronces (Copper), Collahuasi (Copper) and

Kumba."

On prices:

"The Group Mining Ebitda margin was higher than for the first

half of 2020 at 61% (30 June 2020: 38%), due to the increase in the

price for the Group's basket of products and improved production at

PGMs, Kumba (Iron Ore) and Copper, partly offset by unfavourable

exchange rates and higher input costs across the Group"

"Average market prices for the Group's basket of products

increased by 62% compared to the first half of 2020, increasing

underlying Ebitda by $7.9 billion."

"Higher realised prices were achieved across most of our

products, with iron ore increasing by 133%; the dollar PGMs basket

increasing by 47%, driven mainly by a significantly stronger

average rhodium price; and copper increasing by 84%."

On Covid-19 volume recovery:

"The positive $0.8 billion effect on the Group's underlying

Ebitda reflects the easing of the Covid-19 related restrictions

that impacted sales in the first half of 2020, as well as a

recovering diamond market."

"This was partly offset, however, by continued disruption to

production and the supply chain in the first six months of

2021."

On costs:

"The net effect of cost and volume was a $0.5 billion increase

in underlying Ebitda, as strong PGM sales and the impact of PGMs'

ACP outage in 2020 more than offset the effect of logistics

constraints at Kumba and unplanned maintenance at Minas-Rio."

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

July 29, 2021 03:29 ET (07:29 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

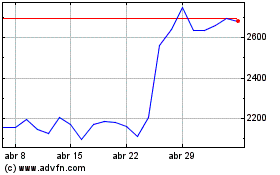

Anglo American (LSE:AAL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

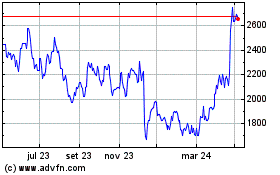

Anglo American (LSE:AAL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024