DigitalBridge Buys Controlling Stake in Vertical Bridge

10 Agosto 2021 - 11:15AM

Dow Jones News

By Robb M. Stewart

DigitalBridge Group Inc. has agreed to buy a controlling stake

in Vertical Bridge Holdings LLC, as Goldman Sachs Asset Management

and the other founding shareholder in the largest private owner of

wireless-communications infrastructure in the U.S. make their

exit.

DigitalBridge said funds affiliated with its

investment-management platform reached a definitive agreement to

buy the stake in a bid to capitalize on a U.S.

telecom-infrastructure market that is expected to see accelerating

momentum.

Vertical Bridge is positioned to continue scaling rapidly,

capitalizing on tower market growth opportunities that are driven

by data consumption and development of next-generation digital

services that underpin investment in next-generation 5G networks

and digital infrastructure, it said.

The financial terms of the acquisition weren't disclosed.

Jordan Co., an infrastructure business within Goldman Sachs

Asset Management, and investment firm Stonepeak Partners said they

were exiting Vertical Bridge after a seven-year investment. The

transaction remains subject to various regulatory approvals and is

expected to close by the end of the year, the companies said.

The companies said Vertical Bridge has since its inception in

2014 completed more than 300 acquisitions and grown its portfolio

to more than 308,000 sites, including over 8,000 owned and

master-leased towers and the nation's largest and tallest

collection of broadcast tower sites.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

August 10, 2021 10:01 ET (14:01 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

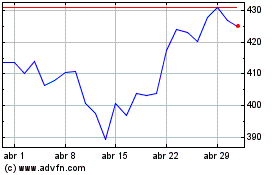

Goldman Sachs (NYSE:GS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

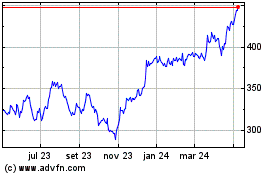

Goldman Sachs (NYSE:GS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024