HSBC Holdings' Net Profit More Than Doubled in 3Q

25 Outubro 2021 - 1:57AM

Dow Jones News

By Yifan Wang

HSBC Holdings PLC's third-quarter net profit more than doubled

from a year earlier, sustaining the strong earnings momentum poster

so far this year as the bank continued to release allowances for

expected credit losses amid rising vaccination rates and an

improving economic outlook.

Net profit surged to $3.54 billion in the quarter from $1.36

billion in the year-ago period, the Asia-focused lender said

Monday. The result beat analysts' expectations in a FactSet

poll.

Revenue rose 1.0% to $12.01 billion, mainly driven by a

favorable foreign-currency translation effect.

The lender also announced a share-buyback program of up to $2

billion thanks to an optimistic business outlook and a strong

capital position.

"While we retain a cautious outlook on the external risk

environment, we believe that the lows of recent quarters are behind

us," Group Chief Executive Noel Quinn said.

Looking ahead, the bank expects pressures on its lending

business to abate as economies continue recovering and central

banks start raising policy rates.

Amid investor concern over China's real-estate sector, HSBC said

it has no direct credit exposure to developers in the "red"

category, and limited exposure to clients categorized as "orange."

The terms refer to Beijing's color code system for property

company's liquidity concerns.

Write to Yifan Wang at yifan.wang@wsj.com

(END) Dow Jones Newswires

October 25, 2021 00:42 ET (04:42 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

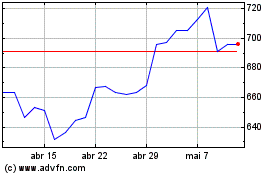

Hsbc (LSE:HSBA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

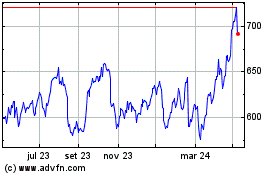

Hsbc (LSE:HSBA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024