Glencore Sees 2021 Marketing Earnings Above Guidance Range -- Update

29 Outubro 2021 - 4:18AM

Dow Jones News

By Jaime Llinares Taboada

Glencore PLC said Friday that it now expects earnings from its

marketing business to be ahead of the guidance range in 2021.

The FTSE 100 company forecast full-year marketing adjusted

earnings before interest and taxes to exceed the top end of the

long-term guidance range of $2.2 billion-$3.2 billion per

annum.

Glencore's marketing arm sources, transports, stores, processes,

sells and delivers commodities to customers.

In addition, the commodity mining and trading company said its

assets performed in line with expectations in the third quarter,

and that full-year production guidance remains unchanged.

The Anglo-Swiss group produced 895,500 metric tons of copper in

the nine months ended Sept. 30, down from 934,700 tons a year

earlier.

Coal output fell to 76.3 million tons from 83.5 million

tons.

"Notably, as energy markets have improved, we are recovering

from the market-driven production cuts initiated within our

Australian coal portfolio in the second half of 2020," Chief

Executive Gary Nagle said.

Cobalt production rose 8% to 23,400 tons, zinc edged down 0.5%

to 855,800 tons, lead was 11% lower at 173,400 tons, and nickel

fell 13% to 71,100 tons. Ferrochrome production increased 65% to

1.07 million tons.

Gold output fell 9% to 593,000 ounces, and silver rose 2% to

23.79 million ounces. Oil was 23% higher, at 4.15 million

oil-equivalent barrels.

Glencore reported that on Oct. 15 it had agreed the sale of its

Chemoil Terminals LLC subsidiary, which owns two oil storage

terminals in California, for $242 million. Closing is expected

before the end of the year.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

October 29, 2021 03:03 ET (07:03 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

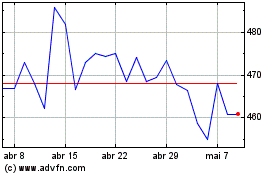

Glencore (LSE:GLEN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

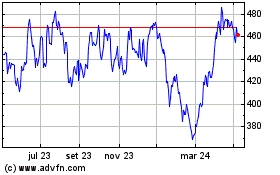

Glencore (LSE:GLEN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024