SSE to Invest GBP12.5 Billion Through Fiscal Year 2026, Sell Stakes in Network Businesses

17 Novembro 2021 - 5:11AM

Dow Jones News

By Jaime Llinares Taboada

SSE PLC said Wednesday that it will speed up investment on

renewables through fiscal 2026, increasing earnings by up to 7% a

year during that period, and that it will seek to sell minority

stakes in its electricity network divisions.

The energy company's Net Zero Acceleration Programme includes a

fully-funded capital investment plan of 12.5 billion pounds ($16.79

billion) to 2026. This represents a 65% increase in annual

investment on the previous plan, or GBP1 billion a year. The money

allocated to grow the renewables business will account for 40% of

the total, and has more than doubled from the previous program.

The company's goal is to add 4 gigawatts of renewable capacity,

doubling current capacity, and grow the asset value of its power

networks to GBP9 billion.

The plan will include further renewables partnering and the sale

of minority stakes in both SSEN Transmission and SSEN Distribution

businesses.

In addition, SSE expects to increase its adjusted earnings per

shares at a compound annual growth rate of 5%-7% to March 2026, and

to pay dividends of at least GBP3.50 across the five years.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

November 17, 2021 02:56 ET (07:56 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

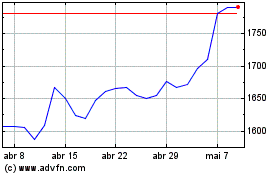

Sse (LSE:SSE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Sse (LSE:SSE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024