Anglo American Expects Costs to Rise Again in 2022

10 Dezembro 2021 - 4:46AM

Dow Jones News

By Jaime Llinares Taboada

Anglo American PLC expects costs to increase further in 2022 and

reaffirmed its full-year guidance for 2021.

The FTSE 100 mining company said Friday that it expects unit

costs to increase by 4% next year, after rising 10% on a

currency-neutral basis in 2021 due to inflation and production

slowdowns.

In addition, Anglo American anticipated a production increase of

7% for 2021 on the back of strong platinum group metals performance

and higher demand for rough diamonds.

As for capital expenditure, the group forecast it will increase

to $6.2 billion-$6.7 billion next year from $5.2 billion in 2021,

when Covid-19 delays and supply-chain disruptions slowed some

projects.

"Anglo American is a resilient and agile business that is set to

deliver 35% growth over the next decade at an attractive 50%

margin. We are also increasing our near-term performance

improvement target to $3.5 billion-$4.5 billion by 2023, as we

accelerate the delivery of our P101 and technology programs, while

also bringing growth projects onstream," Chief Executive Mark

Cutifani added.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

December 10, 2021 02:31 ET (07:31 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

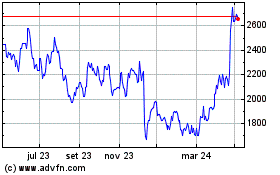

Anglo American (LSE:AAL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

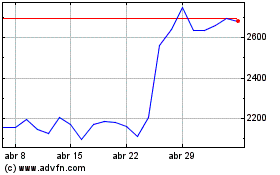

Anglo American (LSE:AAL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024