Uniper Gets EUR10 Billion Credit to Manage Energy Market

05 Janeiro 2022 - 4:06AM

Dow Jones News

By Ed Frankl

Uniper SE said late Tuesday that it has secured additional

financing valued at 10 billion euros ($11.29 billion) to protect

its liquidity in potentially volatile energy markets.

The German energy company said it secured up to EUR8 billion

from its parent company, Finland's Fortum Oyj, which holds more

than 76% of shares in Uniper, to "ensure additional liquidity and

financial flexibility in future, potentially extreme, market

conditions."

Uniper also agreed to a credit facility for as much as EUR2

billion from the German state-owned development bank KfW, with a

term ending on April 30, although the measure hasn't been used so

far and "serves as a back-up facility in case of further extreme

commodity-market developments," the company said.

The Dusseldorf-based company also has drawn down the full volume

of its EUR1.8 billion credit facility from its core banks, it

said.

Uniper said its structural earnings prospects aren't adversely

affected by higher prices, as increased commodity prices lead to

higher margin requirements for the company, and boost the value of

its underlying gas and power assets.

Its products and services are currently in high demand, the

company said.

Write to Ed Frankl at edward.frankl@dowjones.com

(END) Dow Jones Newswires

January 05, 2022 01:51 ET (06:51 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

Uniper (TG:UN01)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

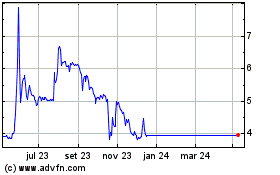

Uniper (TG:UN01)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024