Unilever Says It Won't Raise Offer for GSK Consumer Health Division

19 Janeiro 2022 - 2:15PM

Dow Jones News

By Joe Hoppe

Unilever PLC said Wednesday that it won't increase its 50

billion-pound ($67.98 billion) offer for GlaxoSmithKline PLC's

majority-owned consumer healthcare division, after noting its

financial assumptions and determining it doesn't change its

fundamental value view.

The U.K.-based consumer-goods group said it is committed to

maintaining strict financial discipline in order to ensure its

acquisitions create value for its shareholders.

"Unilever also reiterates its commitment to continuing to

improve the performance of its existing portfolio through its

ongoing focus on operational excellence, its upcoming

reorganization and by rotating the portfolio to higher growth

categories," the company said.

Unilever said on Saturday that it had made an approach to Glaxo

and Pfizer Inc. Glaxo had set out plans to spin off the division,

but also said it would potentially be open to a sale. The unit,

which is 68% owned by Glaxo and 32% by Pfizer, sells products

ranging from Aquafresh toothpaste to Advil painkillers.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

January 19, 2022 12:00 ET (17:00 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

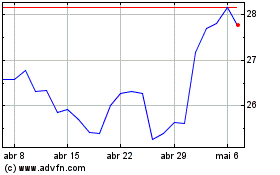

Pfizer (NYSE:PFE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Pfizer (NYSE:PFE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024