Smith & Nephew 2021 Profit Rose on Higher Revenue

22 Fevereiro 2022 - 4:58AM

Dow Jones News

By Ian Walker

Smith & Nephew PLC on Tuesday reported a more-than-doubled

pretax profit for 2021 as the Sports Medicine & ENT and

Advanced Wound Management franchises delivered revenue above

pre-Covid 2019 levels.

The U.K. medical-technology company said it expects growth to be

stronger in the second half of the year than the first, and for

global supply-chain issues to continue.

Pretax profit for the year ended Dec. 31 was $586 million

compared with $246 million in 2020 while revenue rose to $5.21

billion from $4.56 billion.

Revenue for the year rose 10.3% on an underlying basis compared

with guidance for growth at the lower end of the 10% to 13% range

provided by the company on Nov. 4.

For the year ahead, underlying revenue growth is expected to be

in the range of 4.0% to 5.0%.

Trading profit, one of the company's preferred metrics, rose to

$936 million from $683 million in 2020.

Trading profit margin for the year was 18.0% in line with the

lower end of the 18% to 19% range previously guided.

The board has kept its final dividend at 23.1 cents a share,

taking the total payout for the year to 37.5 cents.

Last December, Smith & Nephew set a target for 4%-6% organic

revenue growth a year through to 2024 and for an operating margin

of 21%.

It also said at the time that the board plans to buy back

between $250 million and $300 million of shares this year.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

February 22, 2022 02:43 ET (07:43 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

Smith & Nephew (LSE:SN.)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

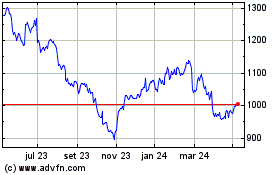

Smith & Nephew (LSE:SN.)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024