U.S. Bancorp Posts Lower 1Q Profit

14 Abril 2022 - 8:38AM

Dow Jones News

By Will Feuer

U.S. Bancorp said its profit for the first quarter fell because

of a higher provision for credit losses.

The Minneapolis-based company, the parent of U.S. Bank, on

Thursday posted net income attributable to the company of $1.56

billion, compared with $2.28 billion a year earlier.

Earnings were 99 cents a share, compared with $1.45 a share.

Analysts polled by FactSet had been expecting earnings of 94 cents

a share.

Net interest income was $3.17 billion, compared with $3.06

billion, the company said. Analysts had been expecting $3.17

billion.

Net revenue was $5.59 billion, compared with $5.47 billion.

Analysts had been looking for $5.56 billion, according to

FactSet.

Provision for credit losses was $112 million, compared with a

benefit of $827 million set aside for possible bad loans in the

year-earlier period, the company said. In the fourth quarter,

provision for credit losses was a benefit of $13 million.

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

April 14, 2022 07:23 ET (11:23 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

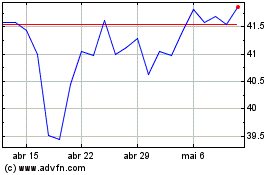

US Bancorp (NYSE:USB)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

US Bancorp (NYSE:USB)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024