UniCredit Confirms $1.7 Billion Buyback Despite Russia Hit; Shares Climb

05 Maio 2022 - 5:51AM

Dow Jones News

By Cristina Roca

Shares in UniCredit SpA rose on Thursday after the bank reported

higher-than-expected revenue and confirmed a 1.6 billion-euro ($1.7

billion) buyback tranche despite booking hefty provisions on its

Russia business.

At 0820 GMT, UniCredit shares traded 6.3% higher at EUR8.94.

The Italian bank posted a net profit of 247 million euros

($262.4 million), down from EUR829 million a year earlier, dragged

by loan-loss provisions of EUR1.28 billion, the bulk of which was

related to Russia.

UniCredit took a conservative approach on its Russia exposure,

which led to higher provisions than the market had expected, Chief

Executive Andrea Orcel told journalists during an earnings call.

The bank is reviewing a possible exit from the country.

Revenue rose 7.3% to EUR5.02 billion, beating analyst views of

EUR4.44 billion, according to a company-compiled consensus.

Underlying trends in the quarter looked strong, Jefferies analysts

Benjie Creelan-Sandford and Marco Nicolai said in a research

note.

UniCredit said the first tranche of its EUR2.6 billion buyback

would begin as soon as possible, which was a positive surprise,

according to Jefferies.

The bank in March cautioned that its buyback could be curtailed

depending on the extent of the Russia hit. It said the second

buyback tranche remains subject to its performance in the country,

but that it is confident it can deliver.

UniCredit also backed its plan to return at least EUR16 billion

to shareholders by 2024 through a mix of dividends and

buybacks.

Write to Cristina Roca at cristina.roca@wsj.com

(END) Dow Jones Newswires

May 05, 2022 04:36 ET (08:36 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

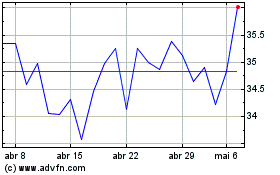

Unicredit (BIT:UCG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

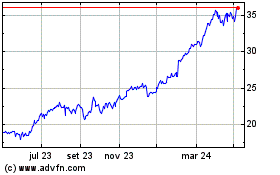

Unicredit (BIT:UCG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024